Social insurance overview

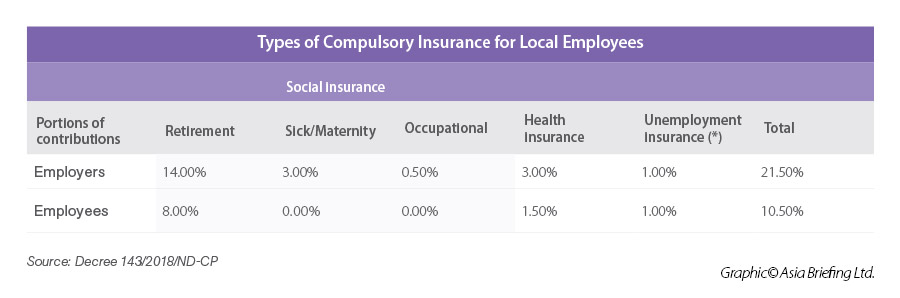

Mandatory minimum contributions are required of both employer and employee. There are three types of mandatory social security in Vietnam and all domestic and foreign companies are required to pay:

- Social insurance for Vietnamese and foreign employees under labor contracts with a definite term of over one month or labor contracts with indefinite terms.

- Health insurance for Vietnamese and foreign employees under labor contracts with a definite term of over three months or labor contracts with indefinite terms.

- Unemployment insurance for Vietnamese employees under labor contracts with a definite term of over three months or labor contracts with indefinite terms.

The scope of compulsory social insurance (SI) coverage has been expanded. Employers must register and pay monthly SI contributions on behalf of their employees through the provincial Social Insurance Authority. The new law also broadens coverage to include certain part-time employees and specific managerial or representative roles.

Social insurance rates

How is social insurance calculated?

Social insurance contributions are calculated based on an employee’s monthly salary or wages. Although the payable amount varies according to individual compensation, contribution caps apply. For social and health insurance, the salary base is capped at 20 times the statutory common minimum wage (currently VND 46.8 million, approximately US$ 1,770). For unemployment insurance, the cap is 20 times the regional minimum wage (up to VND 106.2 million, approximately US$ 4,000), depending on the applicable region.

When a foreign employee’s assignment in Vietnam ends, the individual may be eligible to receive a lump-sum refund of social insurance contributions, subject to certain conditions, including:

- Reaching retirement age without having completed the minimum 20 years of social insurance contributions;

- Suffering from a serious or life-threatening illness as recognized by the Ministry of Health;

- Meeting pension eligibility conditions but no longer residing in Vietnam; or,

- Termination of the employment contract or expiration of the work permit without renewal.

SHUI and trade union fee contributions

|

Item |

Until June 30, 2024 |

From July 1, 2024 |

Note |

|

Statutory pay rate |

VND 1,800,000 |

VND 2,340,000 |

All Vietnam |

|

Maximum SI/HI salary |

VND 36,000,000 |

Adjusted per “reference level” (effective July 2025) |

20 × reference level |

From July 1, 2025, the government will issue new guidance to align all ceilings and thresholds with the “reference level” system introduced by the 2024 Social Insurance Law.

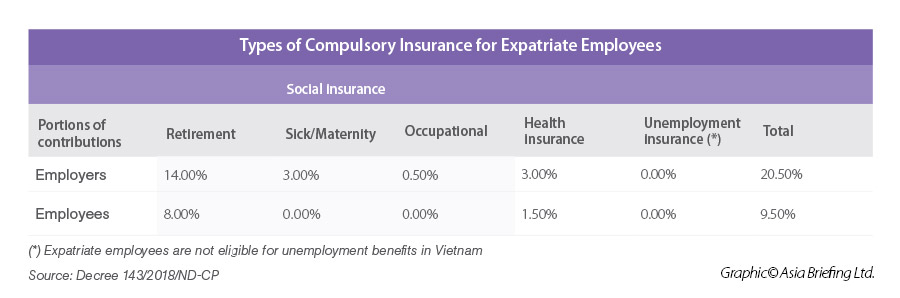

Foreign employee eligibility and criteria

Under Article 2 of the 2024 Social Insurance Law, foreign workers are subject to mandatory SI if they meet the following criteria:

- Have a labor contract of at least 12 months in Vietnam, regardless of the type of work authorization held;

- The statutory retirement age at the time of contract signing (currently being raised gradually to 62 for men and 60 for women);

- Not an internal transferee within the enterprise;

- Not already at or beyond the retirement age; and

- Not covered by an international treaty that provides otherwise.

Exemptions for foreign employees include:

- Internal company transferees as defined by Vietnamese law;

- Foreign employees who have reached retirement age at the time of contract signing;

- Cases where international treaties to which Vietnam is a signatory provide different provisions.

One-off social insurance payment for foreign workers

Once a foreign worker’s employment in Vietnam expires, they may claim a one-off payment from the social insurance agency under these circumstances:

- Reach retirement age but have not contributed in social insurance for the full 20 years;

- Suffer from a fatal disease such as cancer, polio, or HIV;

- Are eligible for pension but reside permanently outside Vietnam;

- Their labor contract terminates, or their permit (of any type) expires without renewal.

The request should be made within 30 days before the contract or permit expiry, and the social insurance authority must process the payment within 10 working days of receipt.

Payment and administrative provisions

Under Clause 4, Article 28 of the new law, the timeframe for issuing a compulsory social insurance book has been shortened to five working days from receipt of a complete application (down from 20 days). Employers are no longer required to post SI payment information every six months, simplifying administrative processes.

Late payments or evasion are now more precisely defined. Employers who delay payments must pay the total unpaid amount plus interest at a rate of 0.03 percent per day of delay. Separate provisions address evasion cases and authorize direct deduction from employer accounts when necessary.

What does social insurance cover?

Social insurance covers employee benefits, including:

- Sick leave

- Maternity leave

- Allowances for work-related accidents and occupational diseases

- Pension allowance

- Mortality allowance

Health insurance entitles employees to medical examination and inpatient/outpatient treatments at authorized facilities.

The 2024 Law also strengthens social pension rights for elderly individuals without sufficient contribution years, partly subsidized by the State.