Vietnam’s business environment, free trade costs, and its ideal location as a China plus one destination make it favorable among foreign investors looking to relocate or diversify their operations.

However, as Vietnam’s economy continues to grow, increasing wages will be an unavoidable feature of doing business in the country and is increasingly important for companies to understand how to navigate.

What are the minimum wage rates in Vietnam?

Vietnam’s regional minimum wage represents the lowest legally mandated pay rate, serving as the foundation for employers to negotiate and determine wages for workers. It applies to all employees working under labor contracts in accordance with the Labor Code — including those in enterprises, cooperatives, farms, households, and other Vietnamese organizations, as well as foreign entities and individuals employing staff in Vietnam.

Vietnam’s minimum wages are divided into four regions, reflecting differences in local living costs and economic conditions. The reorganization of administrative boundaries has also led to a new classification of these regions.

To implement the regional minimum wage system effective in 2026, the government issued Decree No. 293/2025/ND-CP (Decree 293) on November 10, 2025, which replaces Decree No. 74/2024/ND-CP (Decree 74). This new decree revises wage levels and updates the list of areas assigned to each region.

The four regional categories are defined as follows:

-

Region 1: Includes the most economically advanced and urbanized centers of Vietnam, such as Hanoi, Ho Chi Minh City, Hai Phong, and Da Nang — the country’s primary industrial and commercial hubs.

-

Region 2: Covers areas with strong industrial and economic activity but at a slightly lower level than Region 1. This includes much of Binh Duong, Dong Nai, and Can Tho.

-

Region 3: Represents moderately developed areas with emerging industrial and agricultural bases, such as parts of Hai Duong, Khanh Hoa, and Long An.

-

Region 4: Consists of less developed, primarily rural or agricultural regions with limited industrial activity.

Under Decree 293, effective January 1, 2026, the government has increased the regional minimum wage by VND 250,000–350,000 per month (approximately US$9.5–13.3), equivalent to an average 7.2 percent rise. Alongside the wage hike, the decree introduces updated regional classifications and detailed guidance on implementing the new wage structure.

|

Vietnam’s 2026 Minimum Regional Wage |

|||||

|

No. |

Region |

Per month (VND) |

Per month (US$) |

Per hour (VND) |

Per hour (US$) |

|

1 |

Region 1 |

5,310,000 |

201.84 |

25,500 |

0.97 |

|

2 |

Region 2 |

4,730,000 |

179.80 |

22,700 |

0.86 |

|

3 |

Region 3 |

4,140,000 |

157.37 |

20,000 |

0.76 |

|

4 |

Region 4 |

3,700,000 |

140.64 |

17,800 |

0.68 |

Wages for employees who are paid daily or on a weekly basis must not be lower than the minimum wage when converted to monthly or hourly rates.

Who is eligible?

The wage increase applies to employees who work under labor contracts under the labor code, including businesses, organizations, cooperatives, households, and individuals who hire employees on labor contracts.

List of regional administrative units in Vietnam

|

Province/City |

Region I |

Region II |

Region III |

Region IV |

|

Hanoi City |

Wards: Hoan Kiem, Cua Nam, Ba Dinh, Ngoc Ha, Giang Vo, Hai Ba Trung, Vinh Tuy, Bach Mai, Dong Da, Kim Lien, Van Mieu - Quoc Tu Giam, Lang, O Cho Dua, Hong Ha, Linh Nam, Hoang Mai, Vinh Hung, Tuong Mai, Dinh Cong, Hoang Liet, Yen So, Thanh Xuan, Khuong Dinh, Phuong Liet, Cau Giay, Nghia Do, Yen Hoa, Tay Ho, Phu Thuong, Tay Tuu, Phu Dien, Xuan Dinh, Dong Ngac, Thuong Cat, Tu Liem, Xuan Phuong, Tay Mo, Dai Mo, Long Bien, Bo De, Viet Hung, Phuc Loi, Ha Dong, Duong Noi, Yen Nghia, Phu Luong, Kien Hung, Thanh Liet, Chuong My, Son Tay, Tung Thien; Communes: Thanh Tri, Dai Thanh, Nam Phu, Ngoc Hoi, Thuong Phuc, Thuong Tin, Chuong Duong, Hong Van, Phu Xuyen, Thanh Oai, Binh Minh, Tam Hung, Dan Hoa, Phu Nghia, Xuan Mai, Tran Phu, Hoa Phu, Quang Bi, Yen Bai, Doai Phuong, Thach That, Ha Bang, Tay Phuong, Hoa Lac, Yen Xuan, Quoc Oai, Hung Dao, Kieu Phu, Phu Cat, Hoai Duc, Duong Hoa, Son Dong, An Khanh, Gia Lam, Thuan An, Bat Trang, Phu Dong, Thu Lam, Dong Anh, Phuc Thinh, Thien Loc, Vinh Thanh, Me Linh, Yen Lang, Tien Thang, Quang Minh, Soc Son, Da Phuc, Noi Bai, Trung Gia, Kim Anh, O Dien, Lien Minh. |

Remaining wards and communes. |

- |

- |

|

Cao Bang Province |

- |

- |

Wards: Thuc Phan, Nung Tri Cao, Tan Giang. |

Remaining wards and communes. |

|

Tuyen Quang Province |

- |

- |

Wards: My Lam, Minh Xuan, Nong Tien, An Tuong, Binh Thuan, Ha Giang 1, Ha Giang 2; Commune: Ngoc Duong. |

Remaining wards and communes. |

|

Dien Bien Province |

- |

- |

Wards: Dien Bien Phu, Muong Thanh; Communes: Muong Phang, Na Tau. |

Remaining wards and communes. |

|

Lai Chau Province |

- |

- |

Wards: Tan Phong, Doan Ket. |

Remaining wards and communes. |

|

Son La Province |

- |

- |

Wards: To Hieu, Chieng An, Chieng Coi, Chieng Sinh. |

Remaining wards and communes. |

|

Lao Cai Province |

- |

Wards: Cam Duong, Lao Cai; Communes: Coc San, Hop Thanh, Gia Phu. |

Wards: Van Phu, Yen Bai, Nam Cuong, Au Lau, Sa Pa; Communes: Phong Hai, Xuan Quang, Bao Thang, Tang Loong, Muong Bo, Ban Ho, Ta Phin, Ta Van, Ngu Chi Son. |

Remaining wards and communes. |

|

Thai Nguyen Province |

- |

Wards: Phan Dinh Phung, Linh Son, Tich Luong, Gia Sang, Quyet Thang, Quan Trieu, Pho Yen, Van Xuan, Trung Thanh, Phuc Thuan, Song Cong, Ba Xuyen, Bach Quang; Communes: Tan Cuong, Dai Phuc, Thanh Cong. |

Wards: Duc Xuan, Bac Kan; Communes: Dai Tu, Duc Luong, Phu Thinh, La Bang, Phu Lac, An Khanh, Quan Chu, Van Phu, Phu Xuyen, Phu Binh, Tan Thanh, Diem Thuy, Kha Son, Tan Khanh, Dong Hy, Quang Son, Trai Cau, Nam Hoa, Van Han, Van Lang, Phu Luong, Vo Tranh, Yen Trach, Hop Thanh, Phong Quang. |

Remaining wards and communes. |

|

Lang Son Province |

- |

- |

Wards: Tam Thanh, Luong Van Tri, Ky Lua, Dong Kinh. |

Remaining wards and communes. |

|

Quang Ninh Province |

Wards: An Sinh, Dong Trieu, Binh Khe, Mao Khe, Hoang Que, Yen Tu, Vang Danh, Uong Bi, Dong Mai, Hiep Hoa, Quang Yen, Ha An, Phong Coc, Lien Hoa, Tuan Chau, Viet Hung, Bai Chay, Ha Tu, Ha Lam, Cao Xanh, Hong Gai, Ha Long, Hoanh Bo, Mong Cai 1, Mong Cai 2, Mong Cai 3; Communes: Quang La, Thong Nhat, Hai Son, Hai Ninh, Vinh Thuc. |

Wards: Mong Duong, Quang Hanh, Cam Pha, Cua Ong; Commune: Hai Hoa. |

Communes: Tien Yen, Dien Xa, Dong Ngu, Hai Lang, Quang Tan, Dam Ha, Quang Ha, Duong Hoa, Quang Duc, Cai Chien; Special zone: Van Don. |

Remaining wards, communes and special zones. |

|

Bac Ninh Province |

- |

Wards: Kinh Bac, Vo Cuong, Vu Ninh, Hap Linh, Nam Son, Tu Son, Tam Son, Dong Nguyen, Phu Khe, Thuan Thanh, Mao Dien, Tram Lo, Tri Qua, Song Lieu, Ninh Xa, Que Vo, Phuong Lieu, Nhan Hoa, Dao Vien, Bong Lai, Tu Lan, Viet Yen, Nenh, Van Ha, Bac Giang, Da Mai, Tien Phong, Tan An, Yen Dung, Tan Tien, Canh Thuy; Communes: Chi Lang, Phu Lang, Yen Phong, Van Mon, Tam Giang, Yen Trung, Tam Da, Tien Du, Lien Bao, Tan Chi, Dai Dong, Phat Tich, Gia Binh, Nhan Thang, Dai Lai, Cao Duc, Dong Cuu, Luong Tai, Lam Thao, Trung Chinh, Trung Kenh, Dong Viet. |

Communes: Lang Giang, My Thai, Kep, Tan Dinh, Tien Luc, Tan Yen, Ngoc Thien, Nha Nam, Phuc Hoa, Quang Trung, Hop Thinh, Hiep Hoa, Hoang Van, Xuan Cam. |

Remaining wards and communes. |

|

Phu Tho Province |

- |

Wards: Viet Tri, Nong Trang, Thanh Mieu, Van Phu, Vinh Phuc, Vinh Yen, Phuc Yen, Xuan Hoa, Hoa Binh, Ky Son, Tan Hoa, Thong Nhat; Communes: Hy Cuong, Yen Lac, Te Lo, Lien Chau, Tam Hong, Nguyet Duc, Binh Nguyen, Xuan Lang, Binh Xuyen, Binh Tuyen, Luong Son, Cao Duong, Lien Son, Thinh Minh. |

Wards: Phong Chau, Phu Tho, Au Co; Communes: Lam Thao, Xuan Lung, Phung Nguyen, Ban Nguyen, Phu Ninh, Dan Chu, Phu My, Tram Than, Binh Phu, Thanh Ba, Quang Yen, Hoang Cuong, Dong Thanh, Chi Tien, Lien Minh, Tam Nong, Tho Van, Van Xuan, Hien Quan, Tam Son, Song Lo, Hai Luu, Yen Lang, Lap Thach, Tien Lu, Thai Hoa, Lien Hoa, Hop Ly, Son Dong, Tam Dao, Dai Dinh, Dao Tru, Tam Duong, Hoi Thinh, Hoang An, Tam Duong Bac, Vinh Tuong, Tho Tang, Vinh Hung, Vinh An, Vinh Phu, Vinh Thanh. |

Remaining wards and communes. |

|

Hai Phong City |

Wards: Thuy Nguyen, Thien Huong, Hoa Binh, Nam Trieu, Bach Dang, Luu Kiem, Le Ich Moc, Hong Bang, Hong An, Ngo Quyen, Gia Vien, Le Chan, An Bien, Hai An, Dong Hai, Kien An, Phu Lien, Nam Do Son, Do Son, Hung Dao, Duong Kinh, An Duong, An Hai, An Phong, Hai Duong, Le Thanh Nghi, Viet Hoa, Thanh Dong, Nam Dong, Tan Hung, Thach Khoi, Tu Minh, Ai Quoc, Chu Van An, Chi Linh, Tran Hung Dao, Nguyen Trai, Tran Nhan Tong, Le Dai Hanh, Kinh Mon, Nguyen Dai Nang, Tran Lieu, Bac An Phu, Pham Su Manh, Nhi Chieu; Communes: An Hung, An Khanh, An Quang, An Truong, An Lao, Kien Thuy, Kien Minh, Kien Hai, Kien Hung, Nghi Duong, Quyet Thang, Tien Lang, Tan Minh, Tien Minh, Chan Hung, Hung Thang, Vinh Bao, Nguyen Binh Khiem, Vinh Am, Vinh Hai, Vinh Hoa, Vinh Thuan, Vinh Thinh, Viet Khe, Nam An Phu, Nam Sach, Thai Tan, Hop Tien, An Phu, Cam Giang, Cam Giang, Tue Tinh, Mao Dien, Ke Sat, Binh Giang, Duong An, Thuong Hong, Gia Loc, Yet Kieu, Gia Phuc, Truong Tan, Tu Ky, Tan Ky, Dai Son, Chi Minh, Lac Phuong, Nguyen Giap, Nguyen Luong Bang, Phu Thai, Lai Khe, An Thanh, Kim Thanh; Special zone: Cat Hai. |

Communes: Thanh Ha, Ha Tay, Ha Bac, Ha Nam, Ha Dong, Ninh Giang, Vinh Lai, Khuc Thua Du, Tan An, Hong Chau, Thanh Mien, Bac Thanh Mien, Nam Thanh Mien, Hai Hung; Special zone: Bach Long Vi. |

Remaining wards and communes. |

- |

|

Hung Yen Province |

- |

Wards: Pho Hien, Son Nam, Hong Chau, My Hao, Duong Hao, Thuong Hong, Thai Binh, Tran Lam, Tran Hung Dao, Tra Ly, Vu Phuc; Communes: Tan Hung, Yen My, Viet Yen, Hoan Long, Nguyen Van Linh, Nhu Quynh, Lac Dao, Dai Dong, Nghia Tru, Phung Cong, Van Giang, Me So. |

Communes: Hoang Hoa Tham, Tien Lu, Tien Hoa, Quang Hung, Doan Dao, Tien Tien, Tong Tran, Luong Bang, Nghia Dan, Hiep Cuong, Duc Hop, An Thi, Xuan Truc, Pham Ngu Lao, Nguyen Trai, Hong Quang, Khoai Chau, Trieu Viet Vuong, Viet Tien, Chi Minh, Chau Ninh, Thai Thuy, Dong Thuy Anh, Bac Thuy Anh, Thuy Anh, Nam Thuy Anh, Bac Thai Ninh, Thai Ninh, Dong Thai Ninh, Nam Thai Ninh, Tay Thai Ninh, Tay Thuy Anh, Tien Hai, Tay Tien Hai, Ai Quoc, Dong Chau, Dong Tien Hai, Nam Cuong, Hung Phu, Nam Tien Hai. |

Remaining wards and communes. |

|

Ninh Binh Province |

- |

Wards: Tay Hoa Lu, Hoa Lu, Nam Hoa Lu, Dong Hoa Lu, Nam Dinh, Thien Truong, Dong A, Vi Khe, Thanh Nam, Truong Thi, Hong Quang, My Loc. |

Wards: Tam Diep, Yen Son, Trung Son, Yen Thang, Ha Nam, Phu Ly, Phu Van, Chau Son, Liem Tuyen, Duy Tien, Duy Tan, Dong Van, Duy Ha, Tien Son, Le Ho, Nguyen Uy, Ly Thuong Kiet, Kim Thanh, Tam Chuc, Kim Bang; Communes: Gia Vien, Dai Hoang, Gia Hung, Gia Phong, Gia Van, Gia Tran, Yen Khanh, Khanh Nhac, Khanh Thien, Khanh Hoi, Khanh Trung, Nam Truc, Nam Minh, Nam Dong, Nam Ninh, Nam Hong, Minh Tan, Hien Khanh, Vu Ban, Lien Minh, Y Yen, Yen Dong, Yen Cuong, Van Thang, Vu Duong, Tan Minh, Phong Doanh, Co Le, Ninh Giang, Cat Thanh, Truc Ninh, Quang Hung, Minh Thai, Ninh Cuong, Xuan Truong, Xuan Hung, Xuan Giang, Xuan Hong, Hai Hau, Hai Anh, Hai Tien, Hai Hung, Hai An, Hai Quang, Hai Xuan, Hai Thinh, Giao Minh, Giao Hoa, Giao Thuy, Giao Phuc, Giao Hung, Giao Binh, Giao Ninh, Dong Thinh, Nghia Hung, Nghia Son, Hong Phong, Quy Nhat, Nghia Lam, Rang Dong. |

Remaining wards and communes. |

|

Thanh Hoa Province |

- |

Wards: Hac Thanh, Quang Phu, Dong Quang, Dong Son, Dong Tien, Ham Rong, Nguyet Vien, Sam Son, Nam Sam Son, Bim Son, Quang Trung, Ngoc Son, Tan Dan, Hai Linh, Tinh Gia, Dao Duy Tu, Hai Binh, Truc Lam, Nghi Son; Communes: Truong Lam, Cac Son. |

Communes: Ha Trung, Tong Son, Ha Long, Hoat Giang, Linh Toai, Trieu Loc, Dong Thanh, Hau Loc, Hoa Loc, Van Loc, Nga Son, Nga Thang, Ho Vuong, Tan Tien, Nga An, Ba Dinh, Hoang Hoa, Hoang Tien, Hoang Thanh, Hoang Loc, Hoang Chau, Hoang Son, Hoang Phu, Hoang Giang, Luu Ve, Quang Yen, Quang Ngoc, Quang Ninh, Quang Binh, Tien Trang, Quang Chinh, Nong Cong, Thang Loi, Trung Chinh, Truong Van, Thang Binh, Tuong Linh, Cong Chinh, Thieu Hoa, Thieu Quang, Thieu Tien, Thieu Toan, Thieu Trung, Yen Dinh, Yen Truong, Yen Phu, Quy Loc, Yen Ninh, Dinh Tan, Dinh Hoa, Tho Xuan, Tho Long, Xuan Hoa, Sao Vang, Lam Son, Tho Lap, Xuan Tin, Xuan Lap, Vinh Loc, Tay Do, Bien Thuong, Trieu Son, Tho Binh, Tho Ngoc, Tho Phu, Hop Tien, An Nong, Tan Ninh, Dong Tien. |

Remaining wards and communes. |

|

Nghe An Province |

- |

Wards: Hoang Mai, Tan Mai, Truong Vinh, Thanh Vinh, Vinh Hung, Vinh Phu, Vinh Loc, Cua Lo; Communes: Hung Nguyen, Yen Trung, Hung Nguyen Nam, Lam Thanh, Nghi Loc, Phuc Loc, Dong Loc, Trung Loc, Than Linh, Hai Loc, Van Kieu. |

Wards: Quynh Mai, Thai Hoa, Tay Hieu; Communes: Dien Chau, Duc Chau, Quang Chau, Hai Chau, Tan Chau, An Chau, Minh Chau, Hung Chau, Do Luong, Bach Ngoc, Van Hien, Bach Ha, Thuan Trung, Luong Son, Van An, Nam Dan, Dai Hue, Thien Nhan, Kim Lien, Nghia Dan, Nghia Tho, Nghia Lam, Nghia Mai, Nghia Hung, Nghia Khanh, Nghia Loc, Quynh Luu, Quynh Van, Quynh Anh, Quynh Tam, Quynh Phu, Quynh Son, Quynh Thang, Dong Hieu, Yen Thanh, Quan Thanh, Hop Minh, Van Tu, Van Du, Quang Dong, Giai Lac, Binh Minh, Dong Thanh. |

Remaining wards and communes. |

|

Ha Tinh Province |

- |

- |

Wards: Song Tri, Hai Ninh, Hoanh Son, Vung Ang, Thanh Sen, Tran Phu, Ha Huy Tap; Communes: Thach Lac, Dong Tien, Thach Khe, Cam Binh, Ky Hoa. |

Remaining wards and communes. |

|

Quang Tri Province |

- |

Wards: Dong Hoi, Dong Thuan, Dong Son, Dong Ha, Nam Dong Ha. |

Wards: Quang Tri, Ba Don, Bac Gianh; Communes: Nam Gianh, Nam Ba Don, Tan Gianh, Trung Thuan, Quang Trach, Hoa Trach, Phu Trach, Phong Nha, Bac Trach, Dong Trach, Hoan Lao, Bo Trach, Nam Trach, Quang Ninh, Ninh Chau, Truong Ninh, Le Thuy, Cam Hong, Sen Ngu, Tan My, Truong Phu, Le Ninh, Dong Le, Vinh Linh, Cua Tung, Ben Quan, Cua Viet, Gio Linh, Cam Lo, Khe Sanh, Lao Bao, Trieu Phong, Huong Hiep, Dien Sanh. |

Remaining wards, communes and special zones. |

|

Hue City |

- |

Wards: Thuan An, Hoa Chau, My Thuong, Vy Da, Thuan Hoa, An Cuu, Thuy Xuan, Kim Long, Huong An, Phu Xuan, Duong No. |

Wards: Phong Dien, Phong Thai, Phong Dinh, Phong Phu, Phong Quang, Huong Tra, Kim Tra, Huong Thuy, Phu Bai, Thanh Thuy; Communes: Dan Dien, Quang Dien, Binh Dien, Phu Vinh, Phu Ho, Phu Vang, Vinh Loc, Hung Loc, Loc An, Phu Loc, Chan May - Lang Co, Long Quang, Nam Dong, Khe Tre. |

Remaining wards and communes. |

|

Da Nang City |

- |

Wards: Hai Chau, Hoa Cuong, Thanh Khe, An Khe, An Hai, Son Tra, Ngu Hanh Son, Hoa Khanh, Hai Van, Lien Chieu, Cam Le, Hoa Xuan, Tam Ky, Quang Phu, Huong Tra, Ban Thach, Hoi An, Hoi An Dong, Hoi An Tay; Communes: Hoa Vang, Hoa Tien, Ba Na, Tan Hiep; Special zone: Hoang Sa. |

Wards: Dien Ban, Dien Ban Dong, An Thang, Dien Ban Bac; Communes: Nui Thanh, Tam My, Tam Anh, Duc Phu, Tam Xuan, Tam Hai, Tay Ho, Chien Dan, Phu Ninh, Thang Binh, Thang An, Thang Truong, Thang Dien, Thang Phu, Dong Duong, Que Son Trung, Que Son, Xuan Phu, Nong Son, Que Phuoc, Duy Nghia, Nam Phuoc, Duy Xuyen, Thu Bon, Dien Ban Tay, Go Noi, Dai Loc, Ha Nha, Thuong Duc, Vu Gia, Phu Thuan. |

Remaining wards and communes. |

|

Quang Ngai Province |

- |

- |

Wards: Truong Quang Trong, Cam Thanh, Nghia Lo, Kon Tum, Dak Cam, Dak Bla; Communes: Tinh Khe, An Phu, Binh Minh, Binh Chuong, Binh Son, Van Tuong, Dong Son, Truong Giang, Ba Gia, Son Tinh, Tho Phong, Ngok Bay, Ia Chim, Dak Ro Wa, Dak Pxi, Dak Mar, Dak Ui, Dak Ha, Ngok Reo. |

Remaining wards, communes and special zones. |

|

Gia Lai Province |

- |

- |

Wards: Quy Nhon, Quy Nhon Dong, Quy Nhon Tay, Quy Nhon Nam, Quy Nhon Bac, Pleiku, Hoi Phu, Thong Nhat, Dien Hong, An Phu; Communes: Bien Ho, Gao. |

Remaining wards and communes. |

|

Khanh Hoa Province |

- |

Wards: Nha Trang, Bac Nha Trang, Tay Nha Trang, Nam Nha Trang, Bac Cam Ranh, Cam Ranh, Cam Linh, Ba Ngoi, Ninh Hoa, Dong Ninh Hoa, Hoa Thang, Phan Rang, Dong Hai, Ninh Chu, Bao An, Do Vinh; Communes: Nam Cam Ranh, Bac Ninh Hoa, Tan Dinh, Nam Ninh Hoa, Tay Ninh Hoa, Hoa Tri, Thuan Bac, Cong Hai. |

Communes: Dai Lanh, Tu Bong, Van Thang, Van Ninh, Van Hung, Dien Khanh, Dien Lac, Dien Dien, Suoi Hiep, Dien Tho, Dien Lam, Cam Lam, Suoi Dau, Cam Hiep, Cam An, Ninh Phuoc, Phuoc Huu, Phuoc Hau, Phuoc Dinh, Ninh Hai, Xuan Hai, Vinh Hai, Ninh Son, Lam Son, Anh Dung, My Son, Thuan Nam, Ca Na, Phuoc Ha. |

Remaining wards, communes and special zones. |

|

Dak Lak Province |

- |

- |

Wards: Buon Ma Thuot, Tan An, Tan Lap, Xuan Dai, Song Cau, Thanh Nhat, Ea Kao, Tuy Hoa, Phu Yen, Binh Kien, Dong Hoa, Hoa Hiep; Communes: Hoa Phu, Xuan Tho, Xuan Canh, Xuan Loc, Hoa Xuan. |

Remaining wards and communes. |

|

Lam Dong Province |

- |

Wards: Xuan Huong - Da Lat, Cam Ly - Da Lat, Lam Vien - Da Lat, Xuan Truong - Da Lat, Lang Biang - Da Lat, 1 Bao Loc, 2 Bao Loc, 3 Bao Loc, B' Lao, Ham Thang, Binh Thuan, Mui Ne, Phu Thuy, Phan Thiet, Tien Thanh; Commune: Tuyen Quang. |

Wards: La Gi, Phuoc Hoi, Bac Gia Nghia, Nam Gia Nghia, Dong Gia Nghia; Communes: Hiep Thanh, Duc Trong, Tan Hoi, Ta Hine, Ta Nang, Dinh Van Lam Ha, Di Linh, Hoa Ninh, Hoa Bac, Dinh Trang Thuong, Bao Thuan, Son Dien, Gia Hiep, Tan Hai, Dong Giang, La Da, Ham Thuan Bac, Ham Thuan, Hong Son, Ham Liem, Ham Thanh, Ham Kiem, Tan Thanh, Ham Thuan Nam, Tan Lap, Ninh Gia. |

Remaining wards, communes and special zones. |

|

Dong Nai Province |

Wards: Bien Hoa, Tran Bien, Tam Hiep, Long Binh, Trang Dai, Ho Nai, Long Hung, Binh Loc, Bao Vinh, Xuan Lap, Long Khanh, Hang Gon, Tan Trieu, Phuoc Tan, Tam Phuoc; Communes: Dai Phuoc, Nhon Trach, Phuoc An, Phuoc Thai, Long Phuoc, Binh An, Long Thanh, An Phuoc, An Vien, Binh Minh, Trang Bom, Bau Ham, Hung Thinh, Dau Giay, Gia Kiem, Thong Nhat, Xuan Duong, Xuan Dong, Xuan Dinh, Xuan Phu, Xuan Loc, Xuan Hoa, Xuan Thanh, Xuan Bac, Tri An, Tan An, Phu Ly. |

Wards: Minh Hung, Chon Thanh, Dong Xoai, Binh Phuoc; Communes: Xuan Que, Cam My, Song Ray, La Nga, Dinh Quan, Phu Vinh, Phu Hoa, Ta Lai, Nam Cat Tien, Tan Phu, Phu Lam, Nha Bich, Tan Quan, Thuan Loi, Dong Tam, Tan Loi, Dong Phu, Dak Lua, Thanh Son. |

Wards: Binh Long, An Loc, Phuoc Binh, Phuoc Long; Communes: Tan Hung, Tan Khai, Minh Duc, Loc Thanh, Loc Ninh, Loc Hung, Loc Tan, Loc Thanh, Loc Quang, Tan Tien, Binh Tan, Long Ha, Phu Rieng, Phu Trung. |

Remaining wards and communes. |

|

Ho Chi Minh City |

Wards: Sai Gon, Tan Dinh, Ben Thanh, Cau Ong Lanh, Ban Co, Xuan Hoa, Nhieu Loc, Xom Chieu, Khanh Hoi, Vinh Hoi, Cho Quan, An Dong, Cho Lon, Binh Tay, Binh Phu, Binh Tien, Phu Lam, Tan Thuan, Phu Thuan, Tan My, Tan Hung, Chanh Hung, Phu Dinh, Binh Dong, Dien Hong, Vuon Lai, Hoa Hung, Minh Phung, Binh Thoi, Hoa Binh, Phu Tho, Dong Hung Thuan, Trung My Tay, Tan Thoi Hiep, Thoi An, An Phu Dong, An Lac, Tan Tao, Binh Tan, Binh Tri Dong, Binh Hung Hoa, Gia Dinh, Binh Thanh, Binh Loi Trung, Thanh My Tay, Binh Quoi, Hanh Thong, An Nhon, Go Vap, An Hoi Dong, Thong Tay Hoi, An Hoi Tay, Duc Nhuan, Cau Kieu, Phu Nhuan, Tan Son Hoa, Tan Son Nhat, Tan Hoa, Bay Hien, Tan Binh, Tan Son, Tan Thanh, Tan Son Nhi, Phu Tho Hoa, Tan Phu, Phu Thanh, Hiep Binh, Thu Duc, Tam Binh, Linh Xuan, Tang Nhon Phu, Long Binh, Long Phuoc, Long Truong, Cat Lai, Binh Trung, Phuoc Long, An Khanh, Dong Hoa, Di An, Tan Dong Hiep, An Phu, Binh Hoa, Lai Thieu, Thuan An, Thuan Giao, Thu Dau Mot, Phu Loi, Chanh Hiep, Binh Duong, Hoa Loi, Thoi Hoa, Phu An, Tay Nam, Long Nguyen, Ben Cat, Chanh Phu Hoa, Vinh Tan, Binh Co, Tan Uyen, Tan Hiep, Tan Khanh, Vung Tau, Tam Thang, Rach Dua, Phuoc Thang, Tan Hai, Tan Phuoc, Phu My, Tan Thanh; Communes: Vinh Loc, Tan Vinh Loc, Binh Loi, Tan Nhut Binh Chanh, Hung Long, Binh Hung, Cu Chi, Tan An Hoi, Thai My, An Nhon Tay, Nhuan Duc, Phu Hoa Dong, Binh My, Dong Thanh, Hoc Mon, Xuan Thoi Son, Ba Diem, Nha Be, Hiep Phuoc, Thuong Tan, Bac Tan Uyen, Phu Giao, Phuoc Hoa, Phuoc Thanh, An Long, Tru Van Tho, Bau Bang, Long Hoa, Thanh An, Dau Tieng, Minh Thanh, Long Son, Chau Pha. |

Wards: Ba Ria, Long Huong, Tam Long; Communes: Binh Khanh, An Thoi Dong, Can Gio, Thanh An, Kim Long, Chau Duc, Ngai Giao, Nghia Thanh, Long Hai, Long Dien; Special zone: Con Dao. |

Remaining wards, communes and special zones. |

- |

|

Tay Ninh Province |

Wards: Long An, Tan An, Khanh Hau; Communes: An Ninh, Hiep Hoa, Hau Nghia, Hoa Khanh, Duc Lap, My Hanh, Duc Hoa, Thanh Loi, Binh Duc, Luong Hoa, Ben Luc, My Yen, Phuoc Ly, My Loc, Can Giuoc, Phuoc Vinh Tay, Tan Tap. |

Wards: Kien Tuong, Tan Ninh, Binh Minh, Ninh Thanh, Long Hoa, Hoa Thanh, Thanh Dien, Trang Bang, An Tinh, Go Dau, Gia Loc; Communes: Tuyen Thanh, Binh Hiep, Thu Thua, My An, My Thanh, Tan Long, Long Cang, Rach Kien, My Le, Tan Lan, Can Duoc, Long Huu, Hung Thuan, Phuoc Chi, Thanh Duc, Phuoc Thanh, Truong Mit, Nhut Tao. |

Communes: Binh Thanh, Thanh Phuoc, Thanh Hoa, Tan Tay, My Quy, Dong Thanh, Duc Hue, Vam Co, Tan Tru, Thuan My, An Luc Long, Tam Vu, Vinh Cong, Loc Ninh, Cau Khoi, Duong Minh Chau, Tan Dong, Tan Chau, Tan Phu, Tan Hoi, Tan Thanh, Tan Hoa, Tan Lap, Tan Bien, Thanh Binh, Tra Vong, Phuoc Vinh, Hoa Hoi, Ninh Dien, Chau Thanh, Hao Duoc, Long Chu, Long Thuan, Ben Cau. |

Remaining wards and communes. |

|

Dong Thap Province |

- |

Wards: My Tho, Dao Thanh, My Phong, Thoi Son, Trung An; Communes: Tan Huong, Chau Thanh, Long Hung, Long Dinh, Vinh Kim, Kim Son, Binh Trung. |

Wards: Go Cong, Long Thuan, Son Qui, Binh Xuan, My Phuoc Tay, Thanh Hoa, Cai Lay, Nhi Quy, An Binh, Hong Ngu, Thuong Lac, Cao Lanh, My Ngai, My Tra, Sa Dec; Communes: Tan Phu, Tan Phuoc 1, Tan Phuoc 2, Tan Phuoc 3, Hung Thanh, My Tinh An, Luong Hoa Lac, Tan Thuan Binh, Cho Gao, An Thanh Thuy, Binh Ninh, Tan Duong. |

Remaining wards and communes. |

|

Vinh Long Province |

- |

Wards: Thanh Duc, Long Chau, Phuoc Hau, Tan Hanh, Tan Ngai, Binh Minh, Cai Von, Dong Thanh, An Hoi, Phu Khuong, Ben Tre, Son Dong, Phu Tan, Long Duc, Tra Vinh, Nguyet Hoa, Hoa Thuan; Communes: Phu Tuc, Giao Long, Tien Thuy, Tan Phu. |

Wards: Duyen Hai, Truong Long Hoa; Communes: Cai Nhum, Tan Long Hoi, Nhon Phu, Binh Phuoc, An Binh, Long Ho, Phu Quoi, Dong Khoi, Mo Cay, Thanh Thoi, An Dinh, Huong My, Tan Thuy, Bao Thanh, Ba Tri, Tan Xuan, My Chanh Hoa, An Ngai Trung, An Hiep, Thoi Thuan, Thanh Phuoc, Binh Dai, Thanh Tri, Loc Thuan, Chau Hung, Phu Thuan, Long Huu, Hung Nhong. |

Remaining wards and communes. |

|

An Giang Province |

- |

Wards: Long Xuyen, Binh Duc, My Thoi, Chau Doc, Vinh Te, Vinh Thong, Rach Gia, Ha Tien, To Chau; Communes: My Hoa Hung, Tien Hai; Special zones: Phu Quoc, Tho Chau. |

Wards: Tan Chau, Long Phu; Communes: Tan An, Chau Phong, Vinh Xuong, Chau Phu, My Duc, Vinh Thanh Trung, Binh My, Thanh My Tay, An Chau, Binh Hoa, Can Dang, Vinh Hanh, Vinh An, Thoai Son, Oc Eo, Dinh My, Phu Hoa, Vinh Trach, Tay Phu, Thanh Loc, Chau Thanh, Binh An, Hoa Dien, Kien Luong, Son Hai, Hon Nghe; Special zone: Kien Hai. |

Remaining wards and communes. |

|

Can Tho City |

- |

Wards: Phu Loi, My Xuyen, Ninh Kieu, Cai Khe, Tan An, An Binh, Thoi An Dong, Binh Thuy, Long Tuyen, Cai Rang, Hung Phu, O Mon, Thoi Long, Phuoc Thoi, Trung Nhut, Thot Not, Thuan Hung, Tan Loc, Soc Trang. |

Wards: Vi Thanh, Vi Tan, Dai Thanh, Nga Bay, Vinh Phuoc, Vinh Chau, Khanh Hoa, Nga Nam, My Quoi; Communes: Tan Long, Phong Dien, Nhon Ai, Truong Long, Thoi Lai, Dong Thuan, Truong Xuan, Truong Thanh, Co Do, Dong Hiep, Thanh Phu, Thoi Hung, Trung Hung, Vinh Thanh, Vinh Trinh, Thanh An, Thanh Quoi, Hoa Luu, Thanh Xuan, Tan Hoa, Truong Long Tay, Chau Thanh, Dong Phuoc, Phu Huu, Vinh Hai, Lai Hoa. |

Remaining wards and communes. |

|

Ca Mau Province |

- |

Wards: An Xuyen, Ly Van Lam, Tan Thanh, Hoa Thanh, Bac Lieu, Vinh Trach, Hiep Thanh. |

Wards: Gia Rai, Lang Tron; Communes: U Minh, Nguyen Phich, Khanh Lam, Khanh An, Khanh Binh, Da Bac, Khanh Hung, Song Doc, Tran Van Thoi, Dat Moi, Nam Can, Tam Giang, Luong The Tran, Hung My, Cai Nuoc, Tan Hung, Phu My, Phong Thanh, Hoa Binh, Vinh My, Vinh Hau. |

Remaining wards and communes. |

How are minimum wage rates applied?

All contracts must use the minimum wage rates as the lowest amount of compensation for any commercial arrangement between an employer and an employee. Companies should ensure that the correct wage rate is applied, especially in certain special circumstances, including:

- If the company has any branches or affiliate companies in a different subregion, the region-based minimum wage will be applied to all employees of those offices.

- For companies located in an industrial park or the export processing zone, the highest minimum wage rate will apply.

Salary components

In general, an employee’s typical monthly salary package includes their gross salary and mandatory insurance contributions. Personal income taxes (PIT) will be levied on the balance after mandatory insurance contributions have been deducted.

In some cases, the gross salary may also include overtime pay, allowances, and bonuses, as well as additional benefits.

Further, Vietnamese employees must receive compensation in Vietnamese Dong, even if they work for foreign companies. Foreign employers can only base salary rates in either Vietnamese Dong or foreign currencies for foreign employees, but salaries that are based in foreign currencies must be converted into Vietnamese Dong for compulsory social insurance, personal income tax, and trade union pay. The exchange rate is based on the Vietnamese governments' foreign exchange.

Are employees eligible for overtime pay in Vietnam?

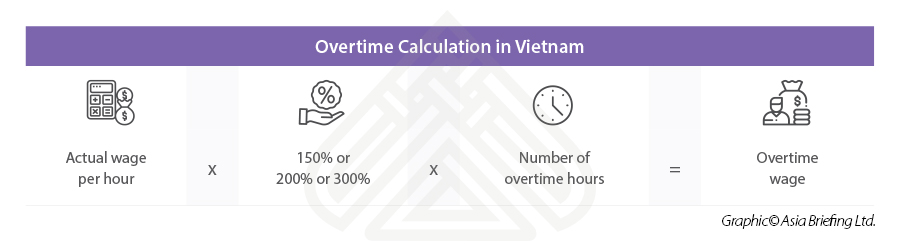

Employee consent must be obtained if the employer plans overtime work regarding the terms, locations, and overtime work. Employees who work extra hours are also paid for those extra hours based on their current hourly wages, as outlined above.

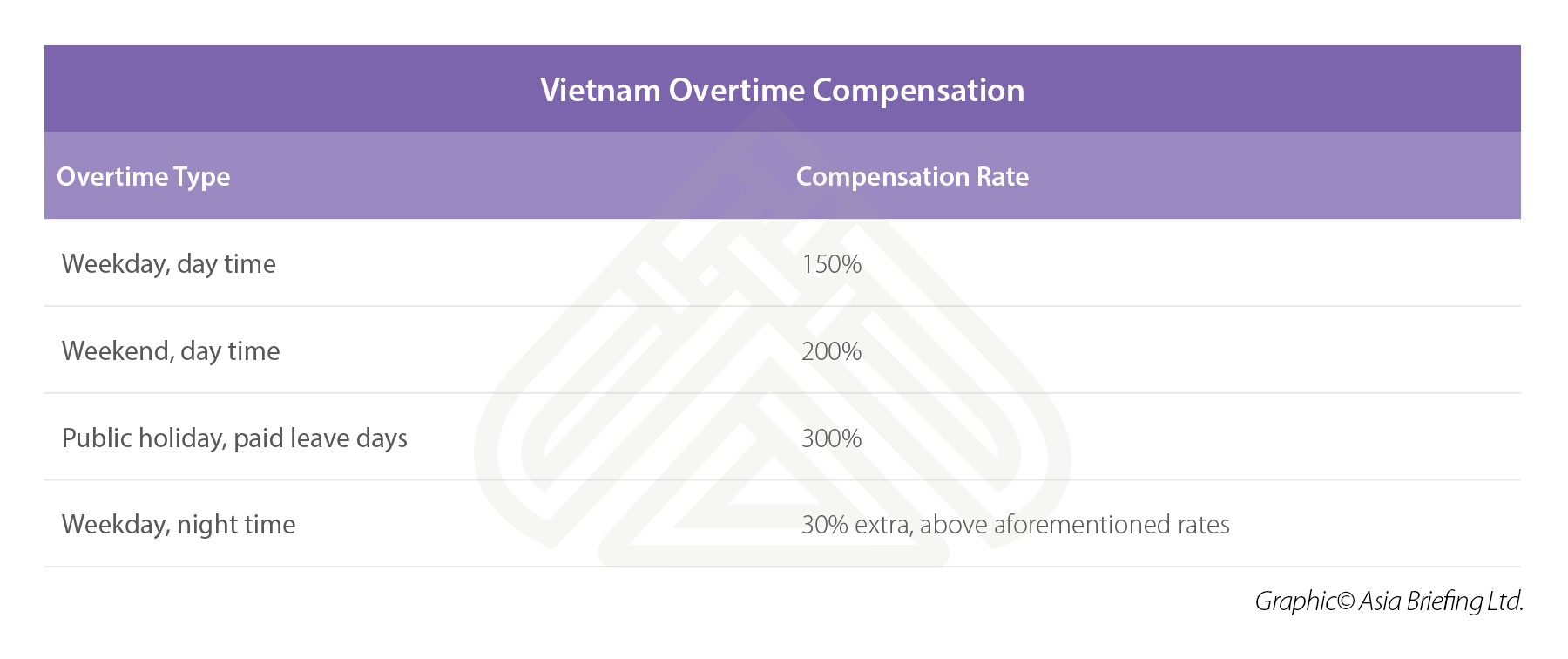

In cases where an employee works overtime hours at night, they are paid extra according to the applicable regulations. Further, employees who are given time off in compensation for working extra hours should be paid the difference between their wages during normal working hours and overtime work. Finally, employees who work night shifts should be paid at least 30 percent higher than normal.

In general, an employee’s typical monthly salary package includes their gross salary and mandatory insurance contributions. Personal income taxes (PIT) will be levied on the balance after mandatory insurance contributions have been deducted.

Overtime compensation

If a company triggers overtime, they will be obligated to compensate employees beyond the wages that are outlined in their contract. This is applicable to all employees regardless of the wages that are offered. The following are the percentages in excess of the standard that are to be applied in the event that certain work-related thresholds are crossed.

There are limitations on the number of overtime hours an employee is allowed to work. As per the labor code, overtime hours cannot exceed 40 hours per month. The code also supplements cases where employers are permitted to organize overtime work for up to 300 hours per year; these include manufacturing and exporting electrical and electronic products as well as work requiring high technical qualifications.

If the employer and employee agree on an overtime deal, employers are permitted to assign their employees to work overtime for over 200 hours but not exceeding 300 hours per year, except in the following cases:

- Employees aged between 15 and under 18;

- Employees having mild disabilities with work capacity reduction of at least 51 percent or employees with severe disabilities or extremely severe disabilities;

- Employees doing arduous, hazardous, dangerous or extremely arduous, hazardous or dangerous work;

- Female employees in their 7th month of pregnancy onward (or the 6th month of pregnancy onward in case they work in the highlands, remote areas, bordering areas, or islands);

- Female employees nursing children aged under 12 months.

In cases where an employee works extra hours at night, they are paid extra in accordance with the applicable regulations. Further, employees who are given time off in compensation for working extra hours will need to be paid the difference between their wages during normal working hours and overtime work. Finally, employees who work night shifts should be paid at least 30 percent higher than normal.

There are special situations which may trigger other regulations within the code for overtime:

- Pregnant women: Women who are in their 7th month of pregnancy and women with babies under 12 months are not allowed to work overtime, work at night, or take long-distance business trips. Pregnant women who are performing heavy work must either be transferred to lighter work or decrease daily work time by an hour while maintaining the same total pay.

- Minor employees:

- Workers under the age of 18: Prohibited from working in dangerous conditions or with potential exposure to toxic substances. The Ministry of Labor, Invalids and Social Affairs (MoLISA) also establishes a limit on which industries and what kind of work minors can undertake.

- Minor employees between the ages of 15 and 18: May work a maximum of eight hours a day and 40 hours a week. They are only permitted to do overtime and night work in certain industries, as specified by the Ministry.

- Workers under the age of 15: Regulations establish a maximum of four hours a day and 20 a week, with no overtime or night work permitted. Working hours for those under 13 years of age are further reduced to one hour per day.

Performance and earnings-based bonuses for employees

Bonuses are given to employees based on company earnings and performance and as a way of boosting company morale and productivity. There are various kinds of bonuses that a company may grant its employees throughout the year.

All salaries and bonuses are subject to PIT in Vietnam.

13th-month salary

A 13th month’s salary is usually given as an “annual bonus” by both local and foreign companies in Vietnam to employees who have worked with the company for at least one year. Employees who have worked at a company for less than one year are typically given a bonus that is prorated and based on their actual employment period.

Lunar New Year or Tet bonus

A special bonus called the “Lunar New Year” bonus (or “Tet Bonus”) is often paid to employees prior to their leaving for the Lunar New Year holiday.

The amount of any Tet Bonus will be dependent on both company and employee performance but typically ranges from smaller amounts of money (up to an entire month’s salary) to larger amounts of money (up to an entire year’s salary) depending on the company's progress and goals.

Additional bonuses

Employees may also be given smaller bonuses for public holidays or other special days (e.g., International Labor Day or National Day). Senior management and other valued employees may be given bonuses during these days as well, including in the form of share certificates with a vesting period, for which the corresponding stock can be sold only after the employee has worked for the company for a certain amount of time.

Allowances and benefits

An employee may be entitled to several kinds of allowances and monetary or non-monetary benefits designed to retain staff. Some of these benefits are non-taxable, including:

- Payments for housing rent, power, water, and associated services for employees that amount to more than 15 percent of their total taxable income;

- Life insurance and optional insurance;

- Payment for a membership card, which does not include the user's name, of golf clubs, tennis courts, and other exclusive clubs;

- Payment for a membership card, which does not include the user's name, of health care, entertainment, etc. services;

- Telephone allowance;

- Stationery allowance;

- Uniform allowance in kind or in cash not exceeding 5 million VND;

- Lunch allowance not exceeding 730,000 VND;

- Funeral payment not exceeding any month's actual salary in the year;

- Wedding payment not exceeding any month's actual salary in the year;

- Transportation allowances;

- Training allowances;

- Employer support for fatal disease or illness;

- Round-trip flight ticket to return home country once a year for foreign employees or Vietnamese employees working abroad;

- Tuition fees for children of foreign workers working in Vietnam study in Vietnam, children of Vietnamese workers working abroad study overseas from kindergarten to high school;

- Personal incomes received from any associations and organizations if the employees receiving the grant are members of these associations and organizations and these associations and organizations’ funding is used from the State budget or managed according to the State's regulations;

- Payments paid by the employer for the deployment, rotating foreign workers to work in Vietnam according to regulations in the labor contract, and complying with the standard labor schedule according to the international practices of some industries such as oil and gas and mining.

Prefixed lump sum amounts (or “khoan chi” amounts) for telephone calls and services, stationery, uniforms, and per diem allowances are not subject to taxes if the amounts are within the levels set out under the relevant regulations.

Foreigners who work in Vietnam are also exempted from PIT on various benefits such as relocation allowances for moving into the country, airfare to their home country, and education fees for their children.