Overview of hiring employees

Companies looking to do business in Vietnam must ensure they follow the provisions of the Labor Code, which contains the legal framework for the rights and obligations of employers and employees with respect to working hours, labor agreements, social insurance, overtime, strikes, and termination of employment contracts, to name a few.

Vietnam’s employment contracts

As per the new labor code which took effect in January 2021, there are now only two types of labor contracts:

- Indefinite term– A contract in which two parties do not determine the term and the time for its termination.

- Definite term - Two parties determine the term as a period not exceeding 36 months and the time for its termination. The definite contract can only be renewed once.

If an employee continues working after the expiration of his or her definite-term labor contract, the contract must be renewed within 30 days after the expiry date, or it will become an indefinite-term labor contract.

An employment contract must contain the following:

- The employer’s name, address; full name and position of the person who concludes the contract on the employer’s side;

- Full name, date of birth, gender, residence, identity card number or passport number of the person who concludes the contract on the employee’s side;

- The job and workplace;

- Duration of the employment contract;

- Job- or position-based salary, a form of salary payment, due date for payment of salary, allowances and other additional payments;

- Regimes for promotion and pay rise;

- Working hours, rest periods;

- Personal protective equipment for the employee;

- Social insurance, health insurance, and unemployment insurance;

- Basic training and advanced training, occupational skill development.

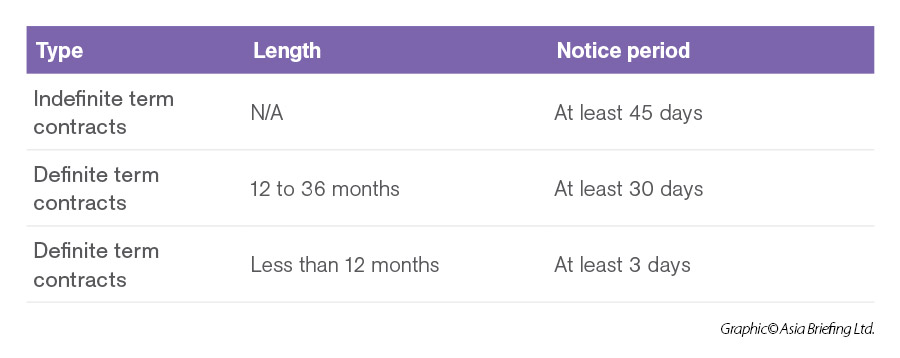

Both employer and employee can unilaterally terminate a contract. The notice period required can vary depending on the type and length of the contract.

Tax obligation for companies

In addition to the basics of hiring contracts and monetary compensation, there are specific laws governing the levying of taxes and the paying of social security for the employee. The employer must be aware of these and be prepared to accommodate deductions made to the employee paychecks.

Withholding and paying individual income tax

A typical monthly salary package consists of gross pay and mandatory social insurance contributions, with personal income tax (PIT) calculated on the remaining balance after these deductions.

Vietnam’s amended PIT Law will take effect from 1 July 2026, with provisions relating to salaries, wages, and business income applying earlier from 1 January 2026. The law maintains multiple income categories, each with its own deductions, exemptions, and tax rates.

An individual is considered a tax resident if they reside in Vietnam for 183 days or more in a calendar year or within a consecutive 12-month period from the first date of entry. Tax residents are taxed on their worldwide employment income at progressive rates of 5 percent to 35 percent, while non-residents are subject to a flat 20 percent tax on Vietnam-sourced income. Employers typically complete annual PIT finalization for employees at the beginning of the following year.

The reforms also update taxable income definitions, exemptions, deductions, and tax brackets. Businesses are encouraged to prepare early by reviewing payroll systems, data processes, and compensation structures, and by consulting tax advisors where necessary.

Tax-exempt incomes

Vietnam’s tax authorities have singled out a number of incomes that are exempt from PIT. These include:

| No. | Exempt Income Category | Scope |

|---|---|---|

| 1 | Real estate transfers between close relatives | Income from transfers, inheritances, or gifts of real estate between spouses; parents and children (biological or adoptive); parents-in-law and children-in-law; grandparents and grandchildren; and biological siblings. |

| 2 | Sale of a single residential property | Income from transferring a residential house, residential land use rights, and attached assets where the individual owns only one residential property in Vietnam. |

| 3 | State-allocated land use rights | Income derived from land use rights directly allocated by the State to individuals. |

| 4 | Agricultural and aquaculture production income | Income from producing unprocessed or minimally processed agricultural, forestry, livestock, aquaculture products; salt production; dividends of agricultural cooperatives; and income under large-scale field, forestry, or aquaculture contracts. |

| 5 | Conversion of agricultural land | Income arising from conversion of agricultural land allocated by the State to households and individuals for production. |

| 6 | Interest income from financial instruments | Interest from government bonds, local government bonds, bank deposits, and life insurance contracts. |

| 7 | Remittances | Income received from overseas remittances. |

| 8 | Night shift and overtime compensation | Night work wages, overtime payments, and compensation for unused statutory annual leave. |

| 9 | Pension income | Pension payments from the Social Insurance Fund, supplementary retirement funds, and voluntary pension schemes. |

| 10 | Scholarships | Scholarships funded by the State or granted by domestic or foreign organizations under study-promotion programs. |

| 11 | Insurance and statutory compensation | Compensation from life and non-life insurance, occupational accident compensation, State compensation, and other statutory compensation. |

| 12 | Charitable income | Income received from legally established charitable or humanitarian organizations operating on a non-profit basis. |

| 13 | Foreign aid income | Income sourced from approved governmental or non-governmental foreign aid for charitable or humanitarian purposes. |

| 14 | Seafarers’ wages | Wages and salaries of Vietnamese seafarers working for foreign shipping lines or Vietnamese lines engaged in international transport. |

| 15 | Offshore fishing and aquaculture services | Income earned by vessel owners, operators, and onboard workers providing goods and services directly supporting offshore fishing and aquaculture. |

| 16 | Carbon and green finance income | First-time transfer of emission-reduction outcomes; income from allocated carbon credits; interest from green bonds; and first-time transfer of green bonds. |

| 17 | Scientific and innovation wages | Wages and salaries from scientific research, technological tasks, or innovation projects. |

| 18 | Innovation royalties | Royalties generated from commercialization of research, technology, and innovation results. |

| 19 | Start-up investment income | Income of individual investors, experts, founders of innovative start-ups, and contributors to venture capital funds. |

| 20 | ODA and international organization income | Wages of foreign experts working on non-refundable ODA or NGO projects; Vietnamese employees of UN organizations; and individuals participating in UN peacekeeping missions. |

| 21 | Post-CIT income of business owners | Post–corporate income tax income of owners of private enterprises and single-member limited liability companies. |

Tax exemptions

In Vietnam, foreign individuals can be exempted from taxation for certain employment benefits. These exemptions include:

| Fully tax-exempt benefits for foreign employees | ||

|---|---|---|

| Benefit | Tax Treatment | Key Conditions |

| One-off relocation allowance | Fully exempt from PIT | Paid to support relocation to Vietnam. |

| Annual round-trip airfare | Fully exempt from PIT | One round-trip ticket per year for annual leave. |

| School tuition for expatriates’ children | Fully exempt from PIT | Applies to general education schools in Vietnam and must be paid by the employer. |

| Conditionally non-taxable employment benefits | ||

|---|---|---|

| Benefit | Non-Taxable Treatment | Conditions |

| Employer-provided housing | Portion exceeding 15% of monthly taxable income is non-taxable | Taxable income excludes the housing benefit itself. |

| Employee transportation | Non-taxable | Shuttle or transportation provided by the employer. |

| Training expenses | Non-taxable | Must relate to the employee’s role or approved training plan. |

| Mid-shift meals and lunches | Non-taxable | Must comply with labor agreements and internal policies. |

| Presumptive allowances (phone, stationery, per diem, uniforms) | Non-taxable | Must stay within prescribed limits. |

| Special occasion bonuses | Non-taxable | Must not exceed one month’s average salary and must be documented. |

| Optional insurance premiums | Non-taxable | Policy must have no premium accumulation and not be subject to insurance tax. |

|

Tax reliefs and incentives |

|

|---|---|

| Category | Incentive |

| Hardship relief | Tax reduction for losses from disasters, epidemics, accidents, or serious illness (capped at tax payable). |

| Digital technology professionals | Five-year PIT exemption for qualified personnel working in digital technology zones, R&D, or training. |

| High-tech R&D personnel | Five-year PIT exemption for strategic and high-technology research activities. |

| Investment fund certificates | PIT exemption if held for at least two years. |

| Investment fund dividends | 50% PIT reduction for dividends from securities or real estate investment funds (government-prescribed period). |

Tax payment

Foreign invested enterprises (FIEs) have to conduct PIT finalization on behalf of their employees at the beginning of the year for taxable incomes arising from the previous year.

If an employee has more than one source of income and wishes to conduct tax finalization on their own, FIEs can issue a certificate of deduction at the request of the employee. If an expatriate’s labor contract in Vietnam expires before the end of a calendar year, they should conduct tax finalization before their departure.

The taxpayer pays PIT to the state treasury in one of two ways: cash or bank transfer. The taxpayer can pay cash directly to the state treasury to receive the voucher from state officials. Otherwise, they can transfer money to a tax office bank account at the state treasury.

Deadlines for tax declarations

The deadline for submitting tax declaration dossiers and payments for monthly and quarterly tax declarations is as follows:

- No later than the 20th day of the month following the month in which the tax liability arises, in the case of monthly declaration and payment;

- No later than the last day of the first month of the quarter following the quarter in which the tax liability arises, in the case of quarterly declaration and payment.

The deadline for submitting tax declaration dossiers according to the year (PIT finalization) is as follows:

- No later than the last day of the 3rd month from the end of the calendar year or fiscal year for the annual tax finalization dossier and payment.

- No later than the last day of the 4th month from the end of the calendar year for personal income tax finalization records of individuals who directly finalize tax.

Social insurance funds

There are three types of mandatory social security in Vietnam that must be covered by foreign enterprises seeking to hire local staff:

- Social insurance;

- Health insurance; and,

- Unemployment insurance (not required for foreing employees).

Both employers and employees are required to make mandatory minimum social insurance contributions. All domestic and foreign enterprises operating in Vietnam must enroll and contribute to social insurance for employees engaged under labor contracts with a term of one month or longer.

Employers are responsible for registering their employees with the Social Insurance Department at the location where the business is registered and for remitting the monthly insurance contributions on the employees’ behalf.

Hiring foreign employees

A Vietnamese entity is permitted to recruit foreign workers in order to work as managers, executive directors and experts where local hires are not yet able to meet production and business requirements. Unlike in certain other Asian countries, Vietnamese representative offices are also able to hire staff directly.

To demonstrate the necessity of a foreign employee, 30 days prior to recruiting the foreign employee, the entity must publicly announce recruitment for this position to Vietnamese job seekers in a Vietnamese newspaper or online portal.

Evidence of this announcement must be presented in the application for a work permit for a foreign employee. The other option is to recruit foreigners through a government-owned employment service center.

When hiring foreign staff in Vietnam, there are a number of procedures and legal frameworks that must be understood.

Work permit procedures and requirements

In order to enter Vietnam, a foreigner needs a visa issued by the Vietnamese Embassy or Consulate. A Vietnamese visa can be granted while in a third-party country or from within Vietnam. Citizens of ASEAN countries receive a free entry visa to Vietnam that lasts between 15 and 30 days, while Vietnam also has an e-visa policy for 80 nationalities lasting until 30 days. However, to work in Vietnam and remain for an extended period, foreigners need to apply for a longer-term three-month single or multiple entry visas.

Employers that require hiring a foreign employee must submit a written request to the Ministry of Labor, War Invalids and Social Affairs (MoLISA), 30 days before the commencement of employment. A response is typically received within 10 days after submission.

The employer should then request a work permit from the MoLISA. This should ideally be applied 15 days before the foreign worker commences their employment. Work permit processing times take up to 10 business days. A work permit cannot be applied directly by the workers/foreigners, but with the assistance of their employers from Vietnam.

Where a work permit is not compulsory, a notice must be submitted seven days in advance to the provincial MoLISA prior to working in Vietnam. Currently, work permits for foreigners are valid for a maximum of two years and can be extended one time for a further two year term. A new application must be made if the company wishes to continue employing the foreign worker.

Work permit requirements

A foreign expert is defined as:

- Having a bachelor’s degree or higher and having at least three years of experience working in the relevant field to the job position that the foreign employee has been hired for;

- Have at least five years of experience with a practice certificate relevant to the job that the foreign employee has been hired for;

- Special cases that fall under the discretion of the Prime Minister as per the MoLISA.

A manager is defined as:

- A person in charge of the organization.

- An executive is defined as:

- An employee directly administering affiliated entities of the employer.

A technical worker is defined as:

- An individual that has been training in a technical field or another major for at least one year and has been working for at least three years in their trained field; or

- Has at least five years’ experience related to the job for which they will be employed in Vietnam.

Documents required and criteria for foreign workers

Foreigners to have a practicing certificate with at least five years of work experience in the job that they will be hired for in Vietnam. Alternatively, an expert needs to have a relevant bachelor’s degree or higher relevant to their job position in Vietnam and a minimum of three years of work experience. In addition, the practicing certificate must be confirmed by an overseas company or organization.

Several documents are required for a work permit application. These include:

- Application form;

- Health certificate issued in the past year as per guidelines by the Ministry of Health;

- Police or criminal clearance certificate, no less than six months old;

- Proof as a manager or executive;

- Proof as an expert or technical worker; and

- Acceptance from MoLISA for the demand for foreign employees.

- To be eligible for a work permit, the applicant must comply with the following conditions:

- At least 18 years of age;

- In good enough health to satisfy job requirements;

- A manager, executive director or expert with technical skills and knowledge necessary for the job; and

- Not currently subject to criminal prosecution or any criminal sentence in Vietnam or overseas or have a criminal record.

- A work permit may be terminated in the following circumstances:

- Expiration of work permit;

- Termination of labor contract;

- The content of the labor contract is not consistent with the work permit granted;

- If the foreign employee is fired by the foreign employer;

- Withdrawal of work permit by authorized state agencies;

- Termination of operation of the company, organization, and partners in Vietnam; and

- The foreigner is sentenced to prison, dies or is proclaimed missing by court.

- The following circumstances exempt the foreigner from needing a work permit:

- Work in Vietnam for less than three months;

- A member of a limited liability company with two or more members;

- The owner of a limited liability company with only one member;

- A member of the board of a joint stock company;

- Arrive in Vietnam to market products and services;

- Work in Vietnam for less than three months in order to resolve an emergency or technologically complex situation that could affect production, which Vietnamese experts or foreign experts currently in Vietnam are unable to resolve;

- Lawyers granted a professional permit in Vietnam;

- Heads of representative offices, chiefs of project offices or someone working for foreign non-government organization in Vietnam;

- Internally transferred within an enterprise, which has a commercial presence in the committed service list of Vietnam with the World Trade Organization, including: business service, information service, construction services, distribution service, education service, environment service, financial service, health service, tourism service, cultural and recreational services and transportation service; and

- Work in Vietnam to supply consulting services on tasks serving to research, build, appraise, monitor and evaluate, manage and process programs and projects that use Official Development Assistance (ODA) in accordance with regulations or agreements in an international treaty on ODA signed between an authorized Vietnam agency and foreign agency.

Read more about visas and work permits in this guide.

Other exemptions

As such, foreigners can only be exempt from a work permit if their capital contribution to the company is at least US$130,400 (VND 3 billion).

Experts, managers, or technicians that enter Vietnam for up to 30 days no more than three times in a year may be exempted from a work permit. Foreign workers married to Vietnamese citizens and living in Vietnam are also exempted from work permits.

In addition, businesses that employ foreign personal that are exempted from a work permit must inform MoLISA at least three days before the employee start working in Vietnam.

Penalty for non-compliance with work permit regulations

Vietnamese authorities are becoming stricter regarding work permits. Those who violate the regulations by working in Vietnam without a work permit may be penalized or, if unable to meet work permit requirements, deported back to their home countries within 15 days. In addition, the employer’s operations may be suspended for three months with a possible penalty of up to US$3,300.

Outsourcing recruiting

Due to challenges involved, it is common for foreign companies to choose to outsource the process of finding suitable candidates for employment. As a result of this trend, there are a growing number of recruitment firms specializing in the Vietnam labor market.

With a working-age population of over 54 million, a steadily increasing proportion of trained workers, and competitive costs compared to neighboring countries, Vietnam’s ample and affordable workforce has always been a key factor in driving foreign inbound investment.

In the current framework, as Vietnam develops into a prominent regional manufacturing hub, companies entering the market need to consider workforce availability and implement appropriate HR strategies to source an appropriate workforce as well as attract and retain the best talent.

FAQ:Understanding Vietnam’s Labor Market and Key HR Compliance

Can you give us an overview of Vietnam’s labor market?

With a population of over 96 million, Vietnam’s labor force makes up 57 percent of the population. The country’s main industries are manufacturing (16% of GDP), services (51%), and agriculture (14%) which employ a significant portion of the labor force. The unemployment rate at the end of 2019 was 2.1 percent.

The labor force is concentrated in different clusters across the country such as the Hanoi metro area, Hai Phong metro area, Da Nang metro area, and Ho Chi Minh City area. We also highlight Nghe An province in the north which has been receiving some attention in recent years and is a potential investment location for investors.

Can you describe the clusters where labor force is concentrated?

Hanoi – Hai Phong metro area

The Hanoi – Hai Phong metro area has an abundant labor force with a young labor structure. The area has a total labor force of 12.7 million which accounts for 22 percent of the national labor force. The labor is most concentrated in industrial clusters such as Hanoi, Bac Ninh, Bac Giang, and Hai Phong. Nevertheless, investors should be aware of labor shortages that can occur in the manufacturing sector due to high turnover rates, especially in the peak season.

Factories typically employ a large number of migrant workers that are both skilled and unskilled. We assess that in the short term labor demand is expected to rise as additional industrial parks come up which may lead to higher competition for unskilled labor. Salary and other welfare will be key to retaining and attracting workers. In the long term, however, demand will gradually decline as factories employ automation techniques.

Due to high living standards and the good quality of labor, costs are high in the area. Labor costs are particularly high in Hanoi, followed by Bac Giang, Vinh Phuc, Hung Yen, and Hai Phong.

Tax incentives have been one of the key elements, making this area become an attractive investment destination for foreign direct investment.

Da Nang metro area

The Da Nang metro area’s workforce accounts for 56 percent of the population. It has a total workforce of 2.1 million which accounts for 3.8 percent of the national labor force. Its young and dynamic workforce has benefitted due to the world-class educational facilities in the area. Investors will find it comparatively easier to source qualified labor in the area due to well-established universities and vocational schools.

Da Nang’s investment climate is creating more jobs and competition for talent, particularly in tourism, real estate, education, entertainment and IT. While this has helped attract employees, some businesses have found it challenging to retain and hire high-tech workers and senior employees. While industrial parks in other parts of Vietnam are far from city centers, most IPs in Da Nang are within the city or right on the outskirts.

Labor costs are higher than the Hanoi-Haiphong metro area but less than the Ho Chi Minh City metro area. The local government’s pro-business policies attracts investors in fishing, infrastructure, services, and tourism industries. Incentives are also provided in specific areas such as the Da Nang High-Tech Park.

Ho Chi Minh City metro area

The Ho Chi Minh City metro area has one of the most abundant labor supply in Vietnam with a high share of migrant labor. The area is known as the commercial hub of the country. Labor is concentrated in industrial clusters such as Ho Chi Minh City, Binh Duong, and Dong Nai. The area has over 10.6 million in total labor force accounting for around 19 percent of the national labor force.

Labor pools in the area are diversified. Investment in services and a wide range of manufacturing provides access to a more niche talent compared to the central and northern regions. In the last decade, professional services, IT and hospitality labor pools have seen significant growth.

While talent is abundant, competition is high for talent among employers. In addition, labor costs in the Ho Chi Minh City metro area are some of the highest in the country. Within this area, labor costs are particularly high in Ho Chi Minh City, followed by Binh Duong, and Dong Nai.

Government incentives are available in terms of financial and non-financial privileges.

Nghe An province

Nghe An is one of the most densely populated provinces with the most abundant labor supply in Vietnam. The province has a total labor force of 1.9 million which accounts for 3.5 percent of the national labor force.

While most of the labor force is involved in agriculture, forestry, and fishery, the manufacturing sector has risen significantly in recent years. However, recruiting skilled labor can be a challenge especially for highly skilled engineers and senior managers. Most of the labor in such positions are from migrant labor. Labor costs in the province are some of the lowest among others due to a low standard of living compared to the North and the South. Most towns and districts come under the difficult to very difficult socio-economic conditions category.

Due to this, a wide range of tax incentives have been applied for projects in these areas such as CIT reduction, import and export tax exemption, land use tax reduction, and land lease fee exemption. The provincial government has also offered several incentives ranging from local labor recruiting and training to investment incentives with great socio-economic impact.

What does the future development of the labor market in Vietnam look like?

The pandemic has affected both the economic conditions and academic performance of candidates affecting high school students from taking exams. Candidates are also sensitive to increasing tuition fees at tertiary education institutions when deciding to study higher when graduating. The expensive education discourages students.

There is also a skills shortage with 50 percent of fresh graduates weak in terms of foreign language skills and adaptability to the work environment. Businesses can find it challenging to source technical workers locally. Specific conditions that require skilled labor are technical workers in various industries and designers in the garment industry.

Salary and other benefits remain key to attracting labor and in the future automation is likely to lead to job cuts. Therefore the labor force needs to improve skills to learn to adapt. Trade unions may also have greater influence in the future.

Top occupations that require vocational training are automotive, electronics, hospitality, mechanical engineer, and textiles and garments.