Vietnam offers a favorable environment for investment - with different regions offering business-friendly policies and investment incentives as well as competitive labor rates and land rents. However, which regions offer optimal conditions for different industries? Read our articles below for more information on various Vietnamese cities and regions.

Overview of Vietnam's newly-merged provincial regions

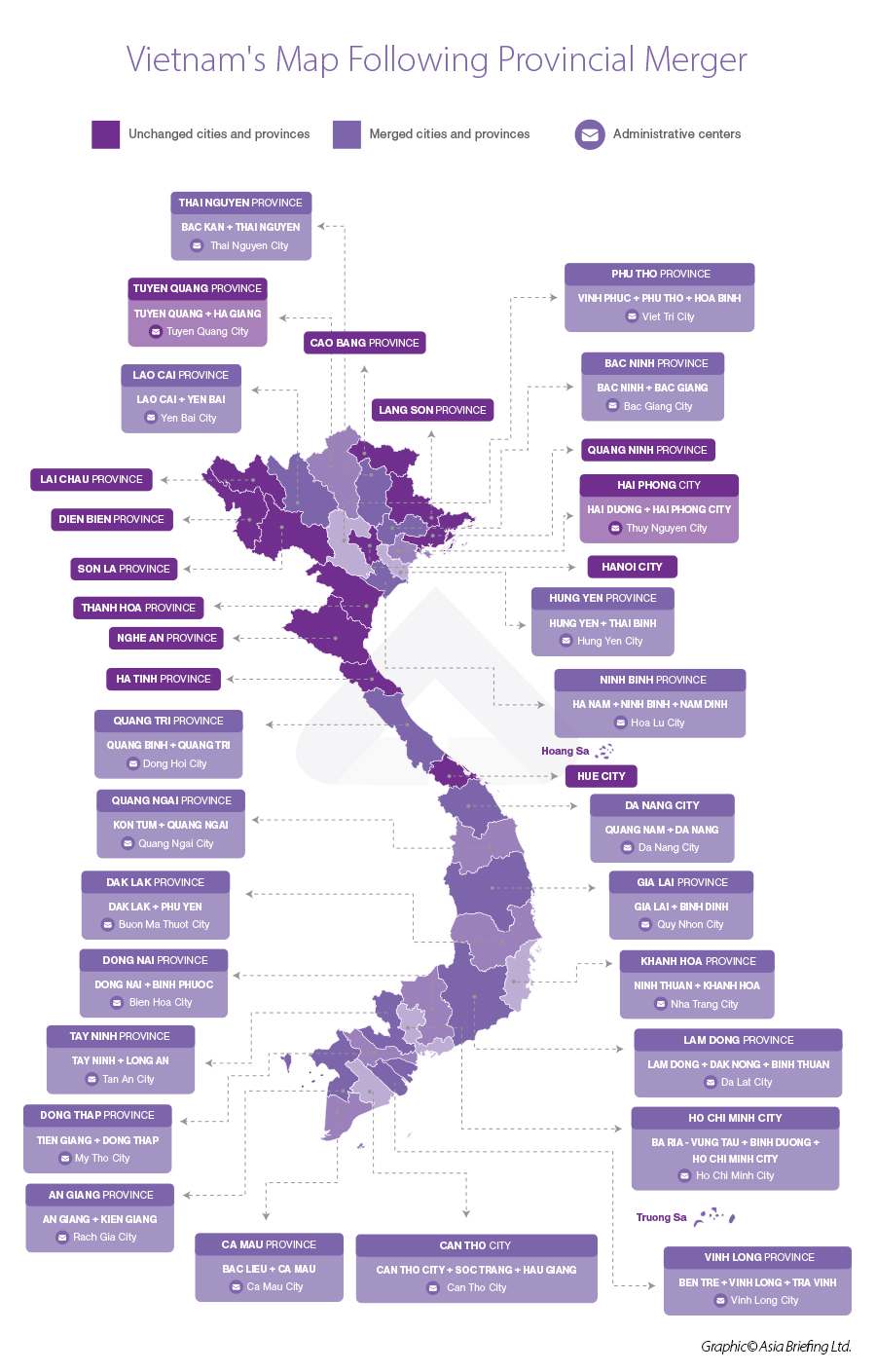

Vietnam’s National Assembly has approved a major administrative restructuring that will reduce the number of provincial-level units from 63 to 34 starting June 12, 2025, including six centrally run cities and 28 provinces. Twenty-three new units will be formed through mergers, and the new administrations will officially operate from July 1, 2025.

Key implementation tasks include:

- Streamlining and reorganizing local government structures;

- Supporting affected officials and workers;

- Ensuring social welfare, citizens’ rights, and local economic, defense, and security needs.

The government must define new boundaries and update administrative maps, with all provinces required to publicly announce new boundaries and leadership structures by June 30, 2025.

The restructuring follows Resolution No. 60-NG/TW (April 2025), which aims to establish a two-level local government model by merging provincial, district, and commune units. According to Decision No. 759/QD-TTg, Vietnam’s 34 administrative units will include:

- 28 provinces, such as Nghe An, Thanh Hoa, Quang Ninh, Dak Lak, and An Giang; and

- 6 centrally governed cities: Hanoi, Ho Chi Minh City, Hue, Da Nang, Can Tho, and Hai Phong.

|

Unchanged Cities and Provinces |

|||

|

No. |

City/Province |

Land area (km2) |

Population |

|

1 |

Hanoi |

3,359.8 |

8,718,000 |

|

2 |

Hue |

4,947.1 |

1,236,393 |

|

3 |

Lai Chau |

9,068.7 |

494,626 |

|

4 |

Dien Bien |

9,539.9 |

653,422 |

|

5 |

Son La |

14,109.8 |

1,327,430 |

|

6 |

Lang Son |

8,310.2 |

813,978 |

|

7 |

Quang Ninh |

6,207.9 |

1,429,841 |

|

8 |

Thanh Hoa |

11,114.7 |

3,760,650 |

|

9 |

Nghe An |

16,485.5 |

3,470,988 |

|

10 |

Ha Tinh |

5,994.4 |

1,622,901 |

|

11 |

Cao Bang |

6,700.4 |

555,809 |

|

Merged Cities and Provinces |

|||||

|

No. |

New name |

Merged unit |

Administrative center (Current name) |

Land area (km2) |

Population |

|

12 |

Tuyen Quang |

Tuyen Quang, Ha Giang |

Tuyen Quang City |

13,795.6 |

1,731,600 |

|

13 |

Lao Cai |

Lao Cai, Yen Bai |

Yen Bai City |

13,257 |

1,656,500 |

|

14 |

Thai Nguyen |

Thai Nguyen, Bac Kan |

Thai Nguyen City |

8,375.3 |

1,694,500 |

|

15 |

Phu Tho |

Phu Tho, Vinh Phuc, Hoa Binh |

Viet Tri City, Phu Tho |

9,361.4 |

3,663,600 |

|

16 |

Bac Ninh |

Bac Ninh, Bac Giang |

Bac Giang City |

4,718.6 |

3,509,100 |

|

17 |

Hung Yen |

Hung Yen, Thai Binh |

Hung Yen City |

2,514.8 |

3,208,400 |

|

18 |

Hai Phong |

Hai Phong, Hai Duong |

Thuy Nguyen City, Hai Phong City |

3,194.7 |

4,102,700 |

|

19 |

Ninh Binh |

Ninh Binh, Nam Dinh, Ha Nam |

Hoa Lu City, Ninh Binh |

3,942.6 |

3,818,700 |

|

20 |

Quang Tri |

Quang Binh, Quang Tri |

Dong Hoi City, Quang Binh |

12,700 |

1,584,000 |

|

21 |

Da Nang City |

Da Nang, Quang Nam |

Hai Chau District, Da Nang City |

11,832.6 |

2,819,900 |

|

22 |

Quang Ngai |

Quang Ngai, Kon Tum |

Quang Ngai City |

14,832.6 |

1,861,700 |

|

23 |

Gia Lai |

Gia Lai, Binh Dinh |

Quy Nhon City, Binh Dinh |

21,576.5 |

3,153,300 |

|

24 |

Khanh Hoa |

Khanh Hoa, Ninh Thuan |

Nha Trang City, Khanh Hoa |

8,555.9 |

1,882,000

|

|

25 |

Lam Dong |

Lam Dong, Dak Nong, Binh Thuan |

Da Lat City, Lam Dong |

24,233.1 |

3,324,400 |

|

26 |

Dak Lak |

Dak Lak, Phu Yen |

Buon Ma Thuot City, Dak Lak |

18,0946.4 |

2,831,300 |

|

27 |

Ho Chi Minh City (HCMC) |

HCMC, Binh Duong, Ba Ria – Vung Tau |

District 1, HCMC |

6,772.6 |

13,608,800 |

|

28 |

Dong Nai |

Dong Nai, Binh Phuoc |

Bien Hoa City, Dong Nai |

12,737.2 |

4,427,700 |

|

29 |

Tay Ninh |

Tay Ninh, Long An |

Tan An City, Long An |

8,536.5 |

2,959,000 |

|

30 |

Can Tho City |

Can Tho, Soc Trang, Hau Giang |

Ninh Kieu District, Can Tho |

6,360.8 |

3,207,000 |

|

31 |

Vinh Long |

Ben Tre, Vinh Long, Tra Vinh |

Vinh Long City |

6,296.2 |

3,367,400 |

|

32 |

Dong Thap |

Dong Thap, Tien Giang |

My Tho City, Tien Giang |

5,938.7 |

3,397,200 |

|

33 |

Ca Mau |

Ca Mau, Bac Lieu |

Ca Mau City |

7,942.4 |

2,140,600 |

|

34 |

An Giang |

An Giang, Kien Giang |

Rach Gia City, Kien Giang |

9,888.9 |

3,679,200 |

Vietnam to have 21 coastal provinces post-merger

Before the restructuring, Vietnam consisted of 63 provinces and centrally administered cities, including 28 coastal areas. Among these, 26 have seaports, while Ninh Binh and Bac Lieu are exceptions. Ninh Binh has one of the country’s shortest coastlines at around 18 km, whereas Bac Lieu has a longer 56 km coastline but still lacks a seaport. Additionally, eight inland provinces and cities also operate seaports despite not being coastal.

Following the consolidation, the number of coastal provinces will decrease from 28 to 21, raising the proportion of coastal provinces from 44 percent to 62 percent. Importantly, all 21 coastal provinces after the merger will have seaports, alongside two non-coastal provinces—Dong Nai and Tay Ninh—that also host seaports.

This new administrative arrangement will ensure that nearly all provinces in Vietnam have seaport access, strengthening the country’s transportation and logistics infrastructure. Such improvements are expected to enhance connectivity, attract investment, and boost economic development, particularly in regions that previously lacked logistical advantages.

Mega-port hubs

The consolidation plan will create large-scale port systems, particularly in the expanded Ho Chi Minh City (HCMC), which will merge HCMC, Binh Duong, and Ba Ria–Vung Tau.

Currently, Ba Ria–Vung Tau has 48 seaports, HCMC has 40, and Binh Duong has the Binh Duong General Port. Once merged, the new centrally governed HCMC will possess an extensive network of 89 seaports, plus 10 offshore oil and gas ports from Ba Ria–Vung Tau—totaling 99 seaports. This will far exceed the existing largest port system in Hai Phong, which has 50 seaports.

Another significant development will occur in the Mekong Delta, where the merger of Can Tho, Soc Trang, and Hau Giang will transform Can Tho City into a coastal city with 21 seaports. Although currently located about 100 km inland, Can Tho already manages 17 type I seaports. Gaining direct sea access will greatly enhance its maritime economy and strengthen its role as the economic hub of the Mekong Delta.

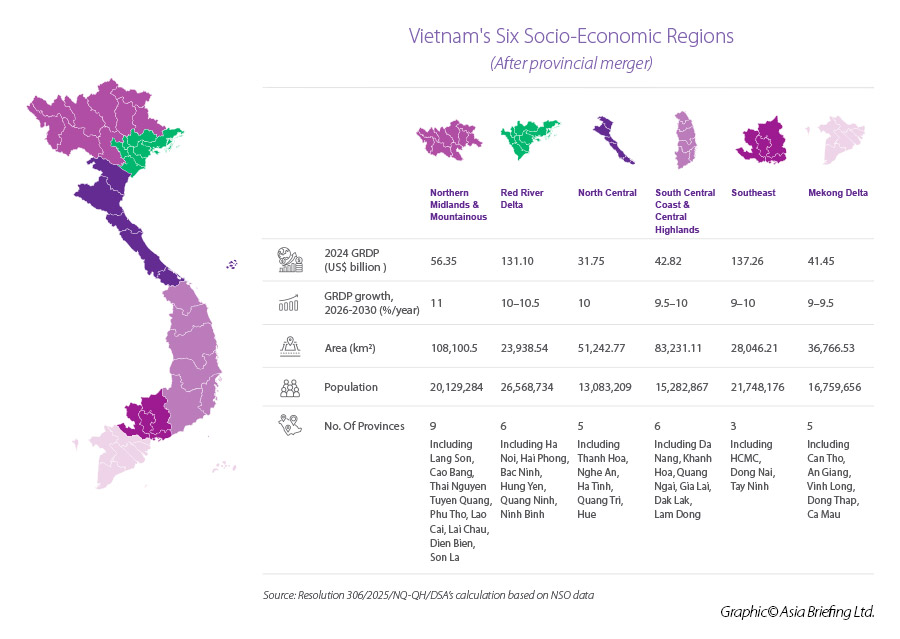

Vietnam's socio-economic zones

Vietnam, strategically located in the Asia-Pacific region with a long coastline along the East Sea (South China Sea), serves as a vital maritime gateway for Laos, Northeast Cambodia, and Southwest China, as well as a bridge connecting China and ASEAN. Under the National Master Plan (Resolution 81/2023/QH15), the country was previously divided into six socio-economic regions, separating mountainous and coastal areas.

However, with the adoption of Resolution 60-NQ/TW on April 12, 2025, Vietnam initiated a major administrative restructuring that consolidates its provinces and cities into 34 provincial-level units.

This new framework merges inland and coastal regions to better utilize shared resources, foster complementary development, and promote balanced economic growth. As a result, Vietnam’s six socio-economic regions are undergoing a deep transformation, unlocking greater potential for sustainable and integrated national development.

Northern Midland and mountainous region

After Vietnam’s administrative restructuring, the Northern Midlands and Mountainous Region now consists of nine provinces:

- Thai Nguyen;

- Cao Bang;

- Dien Bien;

- Tuyen Quang;

- Phu Tho;

- Lai Chau;

- Lao Cai;

- Lang Son; and,

- Son La.

Although its total area has decreased, it remains the country’s largest region, covering over one-third of Vietnam’s territory. The region holds rich mineral and rare earth reserves, giving it substantial economic potential. Strategically located near China’s Southern Economic Corridor, it plays a crucial role in national economic, political, and security strategies, while its proximity to global manufacturing hubs provides opportunities to enhance cross-border trade and infrastructure connectivity.

The region’s resources include coal, iron, zinc, copper, and significant rare earth deposits, particularly in Lai Chau, Lao Cai, and Yen Bai, suitable for large-scale industrial extraction.

However, development is limited by challenging terrain, poor infrastructure, and a shortage of skilled labor, leaving it ranked fifth out of six regions in FDI attractiveness, with high poverty rates and low population density. To address these challenges, the government has set a GRDP growth target of 9–10 percent annually for 2026–2030, focusing on the Thai Nguyen–Phu Tho industrial belt as a key growth engine. Thai Nguyen leads the nation’s smartphone production, largely due to Samsung’s investment, while Phu Tho is attracting major projects in textiles, renewable energy, and electronics from international investors such as INOUE, Yida, Regent Vietnam, BYD, and VSUN.

Red River Delta

Following Vietnam’s administrative restructuring, the Red River Delta has been reorganized from 11 provinces into six localities:

- Hanoi;

- Hai Phong;

- Ninh Binh;

- Bac Ninh;

- Hung Yen;

- Quang Ninh; and,

- Ha Nam.

The inclusion of Bac Giang within the expanded Bac Ninh province is expected to strengthen the region’s competitiveness in electronics, logistics, and high-tech manufacturing. With 26 million residents—about 23 percent of the national population—spread across 23,938 km², the Red River Delta remains Vietnam’s most densely populated region. It aims for a GRDP growth rate of 11 percent annually over the next five years, leveraging its strategic location, industrial infrastructure, skilled workforce, and strong private sector development, ranking second nationwide in both the number of enterprises and FDI attraction.

The region’s industrial landscape has become more consolidated and strategically focused. Bac Ninh, now expanded to 4,700 km² and 3.4 million people, hosts over 30 industrial parks, forming northern Vietnam’s largest industrial concentration. It is central to the nation’s electronics and semiconductor supply chain, attracting global corporations such as Samsung, Foxconn, Amkor, Hana Micron, Canon, Goertek, and Luxshare. A major infrastructure project, the Gia Binh International Airport, is also planned, with Phase 1 slated for 2030, expected to serve 30 million passengers and handle 1.6 million tons of cargo annually.

Hai Phong and Hung Yen ranked third and fourth nationwide in new FDI inflows, with USD 1.24 billion and USD 1.1 billion, respectively, while Hanoi and Quang Ninh followed with USD 273.2 million and USD 181.3 million.

The Red River Delta is thus emerging as Vietnam’s high-tech manufacturing and logistics powerhouse, attracting major global investors—Samsung, LG, Hyundai, Skoda, Fujifilm, Foxconn, Goertek, and Amkor—and creating a synergistic ecosystem that cements its position as a leading investment and innovation hub in Southeast Asia.

North Central Coast

Following the administrative merger, Vietnam’s North Central region now consists of five localities:

- Thanh Hoa;

- Nghe An;

- Ha Tinh;

- Quang Tri; and,

- Thua Thien Hue.

The provinces covered 15.5 percent of the national territory and a home to 13.1 million people as of 2024.

The region’s extensive coastline presents significant potential for marine economic development, yet it continues to face challenges such as frequent natural disasters, uneven development between coastal and mountainous areas, and weak east–west transport connectivity.

To address these issues, the government has set a GRDP growth target of 10–10.5 percent annually for 2026–2030, focusing on improving the performance of seaports, coastal economic zones, and industrial parks. A strategic industrial corridor is planned to link Thanh Hoa’s Nghi Son, Nghe An’s Dong Nam, and Ha Tinh’s Vung Ang Economic Zones, forming the region’s industrial core.

- Within this framework, Thanh Hoa leads the Central region in FDI attraction, anchored by the USD 9 billion Nghi Son Refinery and Petrochemical Project, positioning it as Vietnam’s national hub for energy and petrochemicals.

- Nghe An has become a hub for high-tech and electronics industries, attracting over USD 1.5 billion from global firms such as Foxconn, Luxshare, Goertek, Everwin, Juteng, and Sunny.

- Ha Tinh, home to the USD 12 billion Formosa Steel Complex, is evolving into a world-scale steel production center, while also drawing new investments in LNG and renewable energy as part of Vietnam’s energy transition.

- Meanwhile, Thua Thien Hue is being developed as a regional center for culture, science, higher education, healthcare, seaport services, and international finance, complementing the region’s push toward diversified and sustainable growth.

South Central Coast and Central Highlands

The restructured Central Coast and Central Highlands region now includes six provinces:

- Da Nang;

- Quang Ngai;

- Gia Lai;

- Dak Lak;

- Khanh Hoa; and,

- Lam Dong.

These provinces formed an integrated economic zone that links the mountains, forests, and sea. This merger connects the previously isolated Central Highlands with coastal provinces, addressing long-standing geographic isolation and unlocking new growth opportunities. The region aims for an average annual GRDP growth rate of 9.5–10 percent through 2030, emphasizing expressway expansion, intra-regional transport upgrades, and the development of key corridors connecting to the Southeast region, southern Laos, and northeastern Cambodia.

Among the key growth drivers, Da Nang has emerged as a regional investment hub, attracting major FDI projects such as AIDC DeCenter (USD 200 million), a semiconductor Fab-Lab (USD 80 million), and Dentium’s ICT VINA III facility (USD 177 million).

The city’s future is further shaped by strategic developments like the Da Nang Free Trade Zone, International Financial Centre, and Lien Chieu Deep-Sea Port, all expected to strengthen its role in trade, finance, and logistics.

In the highlands, Gia Lai will supply raw materials and energy for processing industries, while Lam Dong will boost agricultural exports via Phan Thiet Port, lowering logistics costs.

Additionally, Binh Thuan and Ninh Thuan will leverage highland resources to drive industrial growth. Together, these interlinked developments are creating a cohesive regional ecosystem, enhancing economic complementarity between the Central Highlands and the coastal provinces.

Southeast region

After the restructuring, Vietnam’s Southeast Region now consists of Ho Chi Minh City (HCMC), Dong Nai, and Tay Ninh, encompassing 28,046 km² and home to 21.74 million people. Despite the reduction in administrative units, the region has expanded in both population and territory, largely due to the merger of Long An from the Mekong Delta with Tay Ninh. It remains Vietnam’s most urbanized and economically advanced region, contributing 31 percent of the national GDP (about USD 137.26 billion).

The Southeast’s strengths lie in its large labor pool, integrated industrial supply chains, advanced logistics networks, and proximity to major seaports, all of which solidify its position as the country’s primary growth engine.

In the first eight months of 2025, the region attracted robust foreign direct investment (FDI)—USD 1.35 billion in HCMC, USD 990 million in Dong Nai, and USD 767.3 million in Tay Ninh—affirming its reputation as a top investment destination.

Key industries include electronics, machinery, textiles, furniture, and packaging, supported by global investors such as Intel, Nestlé, Coca-Cola, Hyosung, Bosch, Suzuki, Toshiba, Lego, and Pandora.

Following the merger of Vung Tau and Binh Duong into HCMC, the city is set to evolve into a mega-metropolis spanning 6,770 km² with nearly 14 million residents. The expanded HCMC will command one-third of Vietnam’s seaports, including the Thi Vai–Cai Mep deep-sea port—the nation’s largest and the 19th busiest globally—cementing its role as Vietnam’s premier industrial, maritime, and logistics hub.

Mekong Delta

The restructured Mekong Delta region now includes five provinces

- Can Tho;

- An Giang;

- Vinh Long;

- Dong Thap; and,

- Ca Mau.

The provinces spanning about 6,700 km² with a population of 16.8 million. Following the administrative merger, most provinces in the region now have direct coastal access, transforming formerly inland areas such as Can Tho, An Giang, Dong Thap, and Vinh Long into coastal provinces. This shift unlocks new opportunities for marine-based industries, including fisheries, aquaculture, renewable energy, coastal tourism, and seaside industrial zones.

Already Vietnam’s agriculture and aquaculture heartland, the Mekong Delta is set for faster growth through improved logistics, connectivity, and offshore wind energy projects. Industrial activity remains centered on food processing and agro-industry, supported by major investors such as Trungnam Group, Thaco, Orsted, Wilmar International, and Cargill. With expanded coastal access, the region’s integration with the Southeast region and Red River Delta will strengthen national supply chains and enhance Vietnam’s connectivity to global markets.

Vietnam's industrial parks

|

Industrial Zone |

KER |

Industrial Specialization |

Related Logistics Connections |

Tax Incentives |

|

Dinh Vu Industrial Zone |

Northern |

|

|

|

|

Hoa Khanh Industrial Zone |

Central |

|

|

|

|

Vietnam Singapore Industrial Zone |

Southern |

|

|

|