Top reasons to invest in Vietnam

Vietnam has established itself as a stable, rapidly developing, and high-growth destination for international business and foreign investment. Its numerous positive business conditions include a stable political system, a consistent track record of high-performing economic and market growth, an ample workforce of young and skilled laborers, central proximity to East Asia’s top emerging economies, and a relatively open FDI environment. Its business-friendly policies stand out among its Southeast Asian country peers, and it encourages a healthy influx of foreign capital.

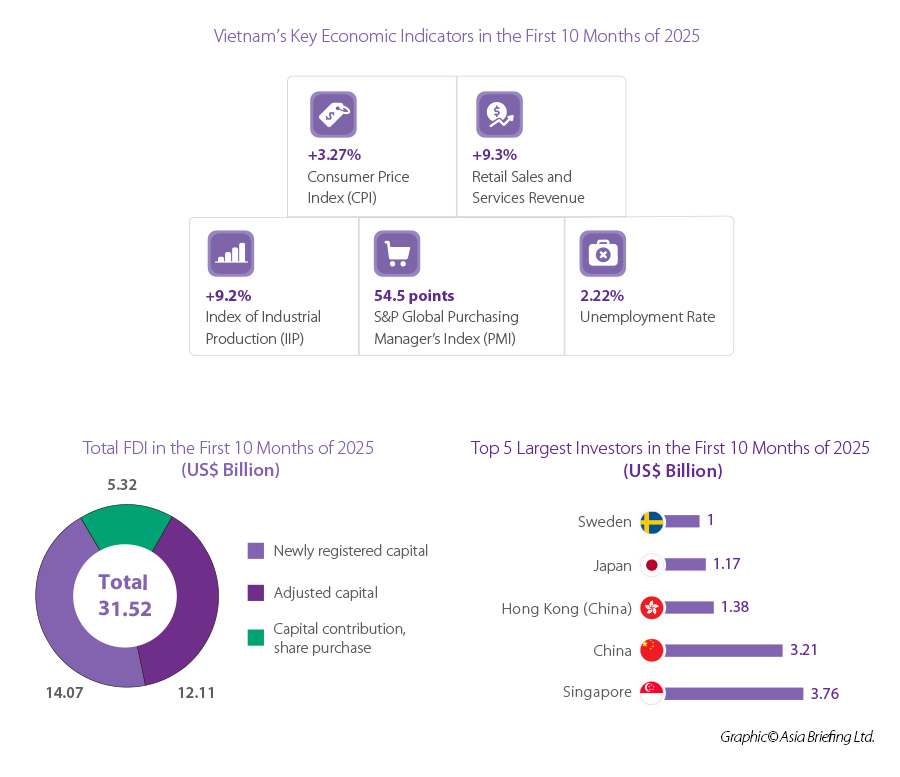

Economists remain optimistic about the performance and prospects of Vietnam's economy. Despite global headwinds and the impact of natural disasters in 2025, Vietnam’s economy demonstrated strong resilience, recording GDP growth of 7.85 percent during the first nine months of the year and supporting increasingly optimistic outlooks among economists. The Asian Development Bank (ADB) revised its 2025 growth forecast upward from 6.6 percent to 6.7 percent and projects approximately 6 percent growth in 2026. Meanwhile, United Overseas Bank (UOB) adjusted its forecast to around 7.5 percent, reflecting improving conditions in manufacturing and export activity.

Amidst these conditions, specific trends are also driving further increases in the country’s inbound investment, and making Vietnam a hotbed for companies from around the world that are seeking to:

- Diversify their Asia presence;

- Access the Vietnam and South Asia markets;

- Supplement their China operations; and,

- Leverage highly attractive free trade agreements, production, and market advantages.

A key recent driver is the evolving US-Vietnam trade relationship, notably reflected in the latest tariff updates and trade policy adjustments by the US. With the US imposing higher tariffs and trade restrictions on certain products sourced from China, many companies are turning to Vietnam to circumvent these barriers, benefiting from Vietnam’s preferential trade agreements with the US, such as the Bilateral Trade Agreement and commitments under the US Generalized System of Preferences (GSP).

Many businesses are now viewing Vietnam as a safer or secondary investment option in Asia for manufacturing, product assembly, and downstream services, rather than relying solely on China. Recent global supply chain disruptions, border closures, lockdowns, and rising labor costs in China have further enhanced Vietnam's competitiveness, supported by these tariff considerations, to attract greater foreign direct investment.

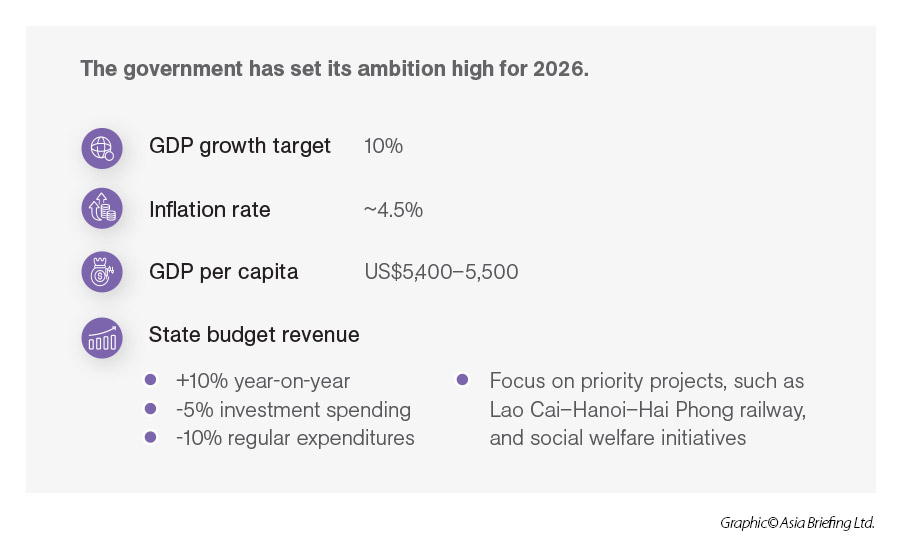

Vietnam is entering a pivotal phase of its development, pursuing ambitious growth objectives while simultaneously restructuring its regional economy. The government is prioritizing high-value growth through policies that enhance productivity, foster innovation, and accelerate industrial upgrading.

Globally, 2026 is expected to remain a year of heightened geopolitical risk and policy uncertainty. The Economist Intelligence Unit (EIU) projects global growth to slow to 2.4 percent in 2026, while the World Trade Organization (WTO) anticipates that the effects of U.S. tariffs on international trade will become more evident during this period.

For Vietnam, 2026 carries particular significance as it marks the start of the final phase of the 10-year Socio-Economic Development Strategy (2021–2030). The year is expected to build momentum for the concluding push toward national growth targets, with an emphasis on high-quality growth, digital transformation, and sustainable development.

Key growth engines in 2026-2030

To sustain and accelerate growth momentum through 2030, the Vietnamese government has established ambitious macroeconomic targets, aiming to raise average annual GDP growth to above 8 percent over the 2021–2030 period, with growth of at least 10 percent per year targeted for 2026–2030. By 2030, per capita GDP at current prices is projected to reach approximately US$8,500, increasing to around US$38,000 by 2050 under the country’s long-term development vision.

Under an updated national planning framework, Vietnam is prioritizing the development of strategic and high-technology industries, including electronics, digital technologies, automotive manufacturing, rail, and shipbuilding. The country also intends to gradually build capabilities in next-generation fields such as semiconductors, robotics, automation, and artificial intelligence. By 2030, Vietnam aims to become Southeast Asia’s second-largest e-commerce market, further strengthening its transition toward a knowledge-based and innovation-driven economy.

Vietnam’s next phase of growth will be supported by a combination of regional growth engines and key enabling sectors:

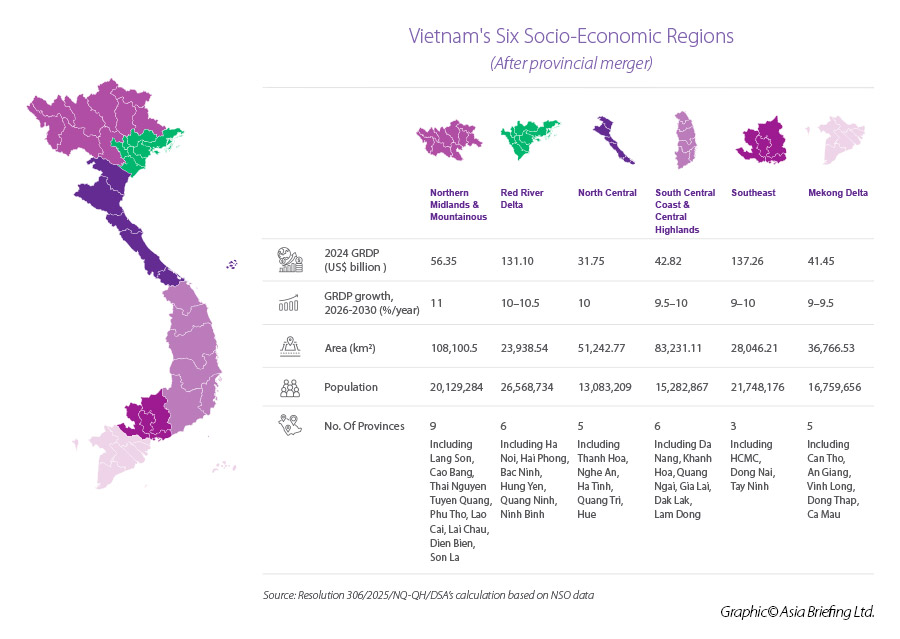

By region:

- North Central Key Economic Zone (Thanh Hoa–Nghe An–Ha Tinh): Targeted as a national center for oil refining and petrochemicals, metallurgy, machinery, automotive manufacturing, and supporting industries, while also advancing high-growth sectors such as electronics, semiconductors, artificial intelligence, and digital technologies.

- Red River Delta: Continues to function as the country’s primary growth engine, leading economic restructuring and spearheading Vietnam’s shift toward an innovation-led growth model.

By enabling sector:

- Infrastructure: Fast-tracking development of the North–South high-speed rail corridor, strengthening international rail connectivity, and expanding urban rail networks in Hanoi and Ho Chi Minh City.

- Energy: Scaling up renewable and clean energy while reviving the Ninh Thuan 1 and 2 nuclear power projects to ensure long-term energy security.

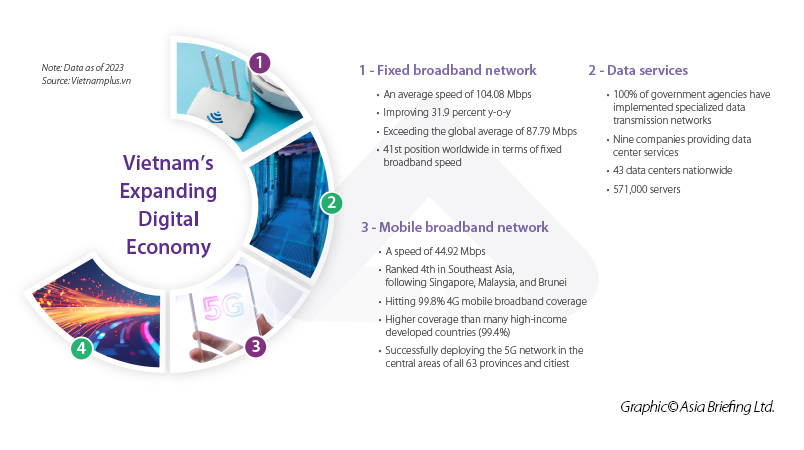

- Digital Infrastructure: Expanding nationwide high-speed fiber and satellite connectivity, rolling out 5G and 6G networks, and establishing a national data center supported by regional data hubs.

A growing economy, expanding middle class and a population reaching 100 million have generated significant revenue in Vietnam from retail sales and consumer services. This continues to increase local disposable income for both urban and rural consumers, resulting in a positive growth outlook in consumer spending and FDI in consumer sectors.

Increased consumer spending in Vietnam has contributed to the growth of numerous industries. The needs of Vietnamese people are changing and can be seen in their demand for higher standards across various sectors, including education, as well as health and leisure, to name a few. For example, there is a growing demand for high-quality education; students enrolled in higher education went from 16 percent in 2005 to 29 percent in 2015.

The digital business landscape is also rapidly evolving and will further impact consumption trends. By 2025, the local digital economy is expected to scale to US$52 billion. Digital economy sub-sectors such as e-commerce, digital banking, and online gaming are nascent and high-growth areas which will be highly attractive for investors.

Vietnam’s Free Trade and tax agreements

Vietnam’s accession into the World Trade Organization (WTO) in 2007 marked its ascension as a committed and robust trade partner for the global community. The country has since entered into numerous Free Trade Agreements (FTA) and Double Tax Avoidance (DTA) Agreements, which have the respective functions of establishing terms of trade that countries impose on imports and exports and eliminating double taxation.

Free Trade Agreements

Vietnam's membership in the ASEAN (Association of Southeast Asian Nations) bloc makes it a party to the following significant multi-regional FTAs:

- RCEP (The Regional Comprehensive Economic Partnership),

- CPTPP (The Comprehensive and Progressive Agreement for Trans-Pacific Partnership)

- EVFTA (The EU-Vietnam Free Trade Agreement).

In all, Vietnam is a signatory to more than 17 bilateral and multilateral Free Trade Agreements, offering direct trade advantages with these countries and regions: Australia, Brunei, Myanmar, Cambodia, Canada, Chile, China, Indonesia, Japan, Laos, Malaysia, Mexico, New Zealand, Philippines, Singapore, South Korea, Thailand, United Kingdom, European Union Countries, Eurasian Economic Union countries.

Double Tax Avoidance Agreements

Double Tax Avoidance Agreements treaties effectively eliminate double taxation by identifying exemptions or reducing the amount of taxes payable in Vietnam.

More than 90 countries and territories have signed DTAs in place with Vietnam, as of 2022. These treaties eliminate double taxation through identifying exemptions or reducing tax payable in Vietnam for residents of the signatories of the agreements.

It is therefore extremely worthwhile for foreign investors to be aware of which double taxation avoidance agreements (DTAAs) between Vietnam and other countries might be applicable to their situation, as well as understand how these agreements are applied.

Why do businesses relocate to Vietnam?

To size up Vietnam, or any country, as a potential destination for relocation, it is vital that foreign investors diligently research their options across many factors that are deemed relevant to their situation. Such factors may include infrastructure, locations, talent availability, access to raw materials, incentives, supply chain partners and logistics, and others.

Here are some top reasons why companies choose to relocate to Vietnam:

- All of the stated Top Reasons to Invest in Vietnam.

- Vietnam continuous track record of high growth, relative to other low-cost countries.

- Vietnam’s decision to open its borders and economy, discontinuing any previous quarantine or lockdown policies, to make it highly accessible for business, travel and normal living and mobility.

- Numerous industrial zones, workforce and labor availability, lower labor costs and a relatively open environment for foreign direct investments.

- Vietnam is a top “China plus one” destination for dealing with rising costs in China and unpredictable scenarios such as trade shocks. Foreign investors favor Vietnam to supplement their China operations for its lower-cost inputs, alternate markets, and convenient geographic and supply route proximity to China.

Relocating from China

Rules of Origin standards were introduced to ensure that exported goods can be legitimately labeled as “Made in Vietnam.” For goods to qualify, they must be either wholly obtained or produced in Vietnam. If this is not possible, the goods must have a minimum Vietnam Input Value (VLC) of 30 percent or fall under the Different Harmonised System (HS) classification.

These standards are increasingly important in the context of recent geopolitical developments, particularly regarding the trade dynamics in the region.

China is committed to promoting seamless trade with Vietnam, including supporting bilateral cooperation in railway, 5G Network, and other infrastructure projects, while accelerating investment cooperation in the digital economy and green development.

This initiative is partly driven by the United States’ tariff-dodging policy as it intensifies efforts to reduce trade with China by increasing tariffs. The policy has greatly boosted imports from Vietnam, which relies on Chinese input for many of its exports. Consequently, this has led to a surge in the China-Vietnam-U.S. trade.

These geopolitical shifts have pressured foreign-invested businesses that had been reliant on China sourcing or production, to diversify or seek alternative destinations. Several countries have benefitted from this diversification, but perhaps none more than Vietnam due to its numerous stated advantages and proximity to China.

China’s operational costs have been rising for more than two decades, in and around its tier 1 and tier 2 cities and are significantly higher in terms of operating costs than Vietnam’s. There is a remarkably high competition in China for skilled labor, and coupled with China’s ageing population has resulted in producing labor shortages in certain manufacturing, high-tech, and other specialized sectors.

Vietnam’s Government aims to accelerate the country’s GDP growth from 7.1 percent in 2024 to 8 percent in 2025 despite the fact that export growth to the US is almost certain to slow from last year’s heady 23 percent surge. Extraordinary measures will be needed to achieve that goal, but the near 40 percent surge in infrastructure investment that the Government is now planning would add about 2 percent to Vietnam’s 2025 GDP growth – if the Government manages to hit its disbursement targets this year.

Vietnam’s transport ministry announced its transport infrastructure master plan between now and 2030, which is estimated to cost between US$43 billion and US$65 billion. Under the master plan, Vietnam will build thousands of kilometers of new expressways, high-speed rail routes, deepwater ports, and new international airports. The government aims for Vietnam to achieve a cargo transportation capacity of 4.4 billion tons per year, and a road transport capacity capable of moving 2.76 tons of cargo and 9.43 million passengers per year - further enhancing the country's transport network and infrastructure to support investment.

Vietnam’s advantage as a China +1 destination

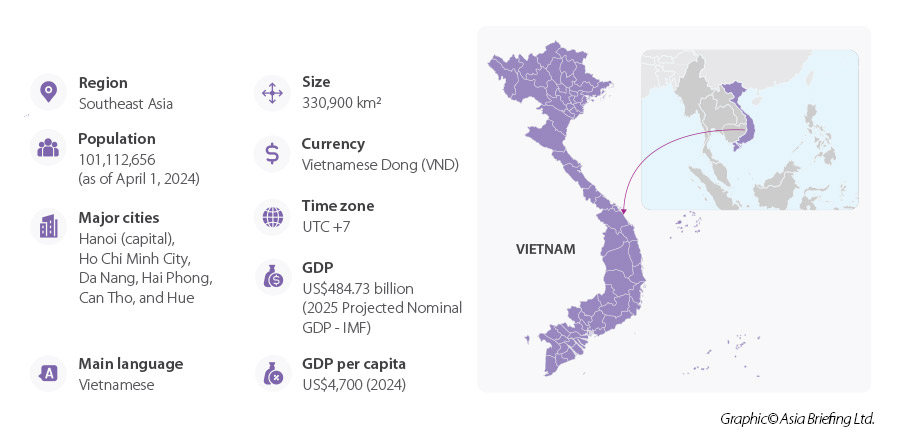

Vietnam’s position in Asia, and its location along key regional shipping routes offers favorable conditions for Vietnam-based manufacturers to be export-focused in general. It has approximately 3,200 kms of coastline, with 114 seaports (as of January 2022), including numerous deepwater port options along its coasts. These advantages come together strongly, when considering Vietnam as a China +1 destination.

Further, as a China +1 option, Vietnam’s close proximity to China, with both land and sea borders, has positioned it as a likely preferred alternative base for manufacturing for many companies. Cities such as Hai Phong in Vietnam are just 865 km away from China’s manufacturing hub of Shenzhen, for example. By situating manufacturing centers close to traditional hubs in China, manufacturers have been able to reduce their costs and avoid adding interruptions or delays to existing supply chains.

Integrations into China supply chains for foreign-invested companies are aided by the fact that many Vietnam factories are China, Taiwan, and South Korea-owned enterprises, which have established robust trading routes and conditions. Transferring existing checklists, specifications, or other product information from such regions has, in many cases, already been pioneered.

Incentives, workforce, and economic zones

Incentives for doing business in Vietnam

The Vietnamese government offers numerous investment-related business incentives and is continually making further improvements through reforms and by further upgrading its incentives to maintain the country’s high appeal to foreign investors. Among all investment incentives, tax incentives tend to be one of the most important to foreign investors and one of the most attractive features of the Vietnamese business landscape.

Tax incentives

Corporate income tax (CIT) incentives are granted to both foreign and local investors to promote investment in sectors or areas that are on par with the national development strategies. There are two main CIT incentives in Vietnam—preferential tax rates (reduced tax rates), and tax holidays (tax exempted for a certain period or, the lifetime of the project). Certain sectors in Vietnam are encouraged for investments through tax exemptions. These include industries which the government prioritizes, such as those it deems qualify for being ‘high tech’, ‘large scale’, or ‘socially important’. Investments into firms that will operate in what the government deems to be a disadvantaged or extremely disadvantaged area can also enjoy a range of preferred tax rates for set terms.

Other incentive types

Several other types of incentives are offered by the Vietnamese government under the newly amended 2025 CIT Law. These are explained elsewhere in our incentives guide, and summarize as follows:

- Industrial park incentives removed

- Location-based CIT holidays and reductions for industrial parks are no longer available for new projects after October 1, 2025.

- Existing projects keep their approved incentives until expiry, with the option to opt into the new regime.

- Lower tax rates for SMEs

- Businesses with annual revenue up to VND 3 billion (~US$115,000): 15 percent CIT.

- Businesses with revenue between VND 3 billion and VND 50 billion (~US$1.9 million): 17 percent CIT.

- Not applicable to subsidiaries/affiliates created to exploit arbitrage.

- Priority sector incentives

- Projects in high-tech manufacturing, semiconductors, renewable energy, green hydrogen, and supporting products may qualify for a 10 percent CIT rate for up to 15 years.

- Incentives are tied to the contribution of national development goals, not just location.

- Expense deductibility clarified

- Expanded rules on deductible expenses, requiring invoices and non-cash payments for amounts ≥ VND 5 million.

- Environmental, R&D, and infrastructure co-financing expenses are now explicitly deductible.

- More detailed lists of non-deductible expenses are added for clarity.

- Expansion projects

- Expansions can continue using the remaining incentives from the original project.

- If original incentives expired, new incentives may apply with separate accounting.

- Foreign income and digital economy

- Overseas income is taxable on an accrual (earned basis), not remittance.

- Digital/e-commerce companies are now covered under permanent establishment rules.

- Foreign shareholders face capital gains tax on gross proceeds, even in loss cases.

Vietnam’s promising workforce

Vietnam’s labor market in 2025 is benefiting from strong economic momentum, with GDP growth reaching 7.09 percent in 2024 and 7.52 percent in the first half of 2025, its fastest pace in 15 years. This expansion has driven employment gains, with the workforce rising to 53 million people and 51.9 million employed. Job creation was especially notable in services such as transportation, accommodation, communications, and retail, fueled by higher consumption and export activity. The sectoral shift away from agriculture toward industry and services reflects Vietnam’s ongoing economic restructuring under Vision 2030.

Demographic trends further shape the labor force, which remains young, dynamic, and increasingly educated. Workers aged 25–49 make up more than 60 percent of the workforce, underpinning labor-intensive industries like manufacturing. At the same time, the share of workers with higher education is climbing, particularly in urban centers, though rural areas continue to lag. The labor force participation rate stood at 68.2 percent, with women’s participation consistently high at over 62 percent, highlighting Vietnam’s relatively balanced gender inclusion compared to regional peers.

Despite these positive developments, structural challenges persist. Informal employment still accounts for nearly two-thirds of jobs, leaving many without adequate social protection or labor rights. The government has introduced measures such as minimum wage adjustments and poverty reduction programs to encourage formalization. Meanwhile, as the population is expected to age after 2030, Vietnam will need to prepare for labor shortages and rising welfare demands. Together, these dynamics underscore both the opportunities and vulnerabilities in Vietnam’s evolving role as a regional hub for manufacturing and services.

Investment Zones and Industrial Parks

Vietnam’s ‘Investment Zones’ (IZs) and ‘Industrial Parks’ (IPs) are planned areas which had been earmarked by the government to offer investment and manufacturing advantages, and as such, they play a key role in growth and foreign investment.

Industrial Parks are locations where most manufacturing takes place. They offer competitive facilities, infrastructure, logistics, and favorable tax incentives, and thereby offer foreign investors significant opportunities to optimize production and maximize profit. These IPs are concentrated in the North, Central, and South of Vietnam. Based on these locations along trade routes, these zones can be readily integrated into supply chains servicing China, Europe, or Pacific trading partners.

|

Industrial Zone |

KER |

Industrial Specialization |

Related Logistics Connections |

Tax Incentives |

|

Dinh Vu Industrial Zone |

Northern |

|

|

|

|

Hoa Khanh Industrial Zone |

Central |

|

|

|

|

Vietnam Singapore Industrial Zone |

Southern |

|

|

|

IZs are typically centered around the major cities and economic centers. So, in the North, IZs are located around Hanoi, in the Central region in and around Da Nang, and in the South in and around Ho Chi Minh City. Yet as land prices and occupancies increase over time, IZs are increasingly developed farther away from economic centers.

Summary: Top 10 Reasons to Invest in Vietnam

|

1. |

Strategic Location |

Strategic destination for manufacturing and China +1, located along shipping and transport routes, bordering South China, and centered along East Asia. |

|

2. |

Growing Economy |

Strong economic GDP growth including continuing annual GDP growth, consistently outperforming its global and regional peers. |

|

3. |

Stable Government |

Relatively stable government with a solid economic vision, fair policy control, low investment barriers, and strong incentives schemes relative to similar markets. |

|

4. |

Strong growth engines |

Vietnam has set ambitious targets to sustain growth through 2030, aiming for over 8 percent average annual GDP growth, at least 10 percent annually in 2026–2030, and per capita income of about US$8,500 by 2030, rising to roughly US$38,000 by 2050. |

|

5. |

Large, young labor force |

Labor force of nearly 60 million workers, which is growing by 1 million workers annually; |

|

6. |

Industrial Zones |

Well-developed Economic Zones, Industrial Parks, Business Districts, and Residential Centers. |

|

7. |

Strong FDI Environment |

A strong FDI environment: A total of US$38.23 billion in 2024. |

|

8. |

Growing Consumer Spending |

Population reaching 100 million, a rapidly expanding middle class, and a growing services sector which exceeds 40% of GDP. |

|

9. |

Network of FTA's |

Signatory of more than 17 Free Trade Agreements, giving trade advantages through countries in APAC, ASEAN, Europe, and elsewhere globally. |

|

10. |

Integration with Legal Frameworks |

WTO member and signatory of the most major worldwide Intellectual Property Protection conventions, protocols, and agreements. |

FAQ: Why and How to Enter the Vietnamese Market

Can you summarize the Vietnam market and its development key points?

Vietnam is a fast and emerging market with stable economic growth and governance. In 2019, Vietnam recorded 7 percent growth. Last year despite the pandemic, Vietnam recorded growth of 2.91 percent above China’s and is one of the few countries in the world to record net positive growth. Not only this, exports grew along with FDI disbursement. The top five sectors receiving investment were manufacturing and processing at US$12.73 billion followed by real estate, electricity production, wholesale and retail, science and technology, and others.

Singapore, South Korea, China, and Japan remain the largest investors in Vietnam. While you can see several investments in areas such as retail markets, buildings, and infrastructure from investors from South Korea and Japan an interesting point to note is that several US and EU investors use their holding companies in Singapore to invest into Vietnam.

Vietnam continues to depend heavily on raw inputs from China, South Korea, and ASEAN with top exports to the US, China, and the EU. In addition, top imports include computers and electronic components, followed by machinery and equipment, telephones and components, textile fabrics, and plastics. A lot of these include raw materials.

Vietnam’s top exports include telephones, computers, and electronics – this is demonstrated by Samsung’s factories in Ho Chi Minh City and Back Ninh contributing to growing smartphone exports. Samsung’s mobile phone exports account for more than 50 percent of the company’s global mobile phone supply as per statistics.

Why should companies consider moving from China to Vietnam?

There are several reasons for moving your production from China to Vietnam, but I will focus on four main ones. The first is low-cost manufacturing. This is one of the most well-known reasons for moving to Vietnam however this is a slightly old and outdated reason to do so. While it’s true that Vietnam remains a lost-cost manufacturing center with lower labor costs, Vietnam is now looking for hi-tech investment prioritizing certain hi-tech industries for growth. And while wages are low, compared to China, they are slowly inching higher as the country experiences economic growth.

The second reason is escaping tariffs. Vietnam is able to circumvent duties due to its participation in several free trade agreements. This trend especially started to pick up due to the US-China trade war and the additional push of Vietnam’s intertwining in global FTAs.

The third reason is Vietnam’s as an import/export processing center in Asia. Vietnam’s geographical location helps as it borders China and is in close proximity to other ASEAN countries. It is the go-to choice for regional distribution in ASEAN and APAC if not in global import and processing. Vietnam’s FTAs and double tax agreements are a significant contributor to this trend as well.

The fourth reason is the exodus of foreign professionals relocating to Vietnam, particularly prior to the pandemic. Vietnam’s living costs are typically much cheaper than China’s and are therefore reasonable. Vietnam has a friendly environment and is more open to travelers in general. While there are internet restrictions – social media, search engines, and messaging platforms can be accessed in the country making it easier for foreigners to live here.

It is important to note that Vietnam can be a manufacturing hub but never Asia’s manufacturing hub, simply because of Vietnam’s size compared to China’s. China has 16 times the workforce compared to Vietnam. Foreign investors should be careful with their expectation management when they look to relocate or supplement their China operations.

How can an investor enter the Vietnamese market?

There are several ways you can enter the Vietnam market. One of the factors that an investor should consider is location. Vietnam’s regions vary and the North, Center, and South, have particular advantages for different industries and types of businesses depending on the investors’ business. For example, the North is good for companies relocating from China but may have higher labor costs. The South is the economic center of the country and may have more opportunities as it has a large consumer base. The center is comparatively less competitive and is a low-cost destination but may be ripe for investment due to several government incentives in cities such as Da Nang.

While there are several office structures to enter the Vietnamese market, in our experience the representative office (RO) and the foreign-invested entity (FIE) are the most popular investment vehicles in Vietnam.

Are there any recent changes to business regulations that an investor needs to be aware of?

The government recently passed the Law on Investment and Law on Enterprises which came into effect in January 2021. These amended laws simplify business registration procedures while also providing updates on conditional business lines, investment incentives, support mechanisms while removing administrative approvals for certain types of investment projects.

Some of the changes include the removal of the seal specimen and more protection for minority shareholders. However, an important factor to note is that for the first time the Law on Investment includes a ‘negative list’. These are sectors where foreign investors are banned from investment such as ‘debt collection services’. The other category is conditional business lines where foreign investment is allowed but subject to government approval for certain sectors.

In addition, the foreign ownership threshold has been lowered from 51 percent to 50 percent. This means that if the threshold is at 50 percent then the company will be treated as a local company. This also means that M&A approval is not required if the transaction does not result in an increase of foreign investors’ ownership ratio in the target company.