For whatever reason, investors may decide to wind up operations and close a company. Undoubtedly, most investors do not hope or expect to stop their business activities, but it may take time for executives to become fully aware of the responsibilities they can face in dissolving or liquidating a company.

Reasons for closure

A company may be dissolved under any of the following circumstances:

- If the operation period stated in the company charter expires and is not extended;

- Decision of dissolution by the enterprise owner (in the case of a private enterprise);

- Decision of dissolution by all unlimited liability partners (in the case of a partnership);

- Decision of dissolution by the Members’ Council or the company owner (in the case of a limited liability company);

- Decision of dissolution at the General Meeting of Shareholders (in the case of a joint-stock company);

- If the company does not have the minimum number of members as stipulated by the relevant laws for a period of six consecutive months without converting into another type of business; or,

- If the company’s business registration certificate is revoked.

Timeframe: Dissolving a company normally takes around four to six months or more depending on the tax finalization process.

What needs to be done?

The owner of the company will need to issue a decision of dissolution statement that includes the following content when deciding to dissolve:

- Company name;

- Head office address;

- Business registration number;

- Reason(s) for dissolution;

- The deadline and procedures for liquidating the company’s contracts and loans (which should be within six months of the company’s dissolution date); and

- Solutions for any obligations arising from labor contracts.

The document will need to be signed and sent to each relevant agency and individual (i.e., the business/investment registration agencies, creditors, individuals who have any relating rights, benefits and obligations and all employees).

To close the company, the investor must:

- Finalize and pay all tax and financial obligations to the government to close the tax code of Company (if any);

- Finalize and pay all personal income tax, social insurance, and health insurance of all employees and get a confirmation letter issued by relevant competent authority finalizing such actions;

- Liquidate all employment contracts and other contracts such as office leasing contract, the contract with some suppliers; and

- Settle all outstanding debts.

Within seven working days after being passed, the resolution on dissolution must be sent to the licensing authorities, all creditors, persons having related rights, obligations or interests, and employees in the Company and must be publicly posted at the head office and branches of the Company.

Tax and customs

If the company registered an import-export tax code, the code would need to be closed when the company is dissolved.

To do this, the company needs to send a letter to the General Department of Customs (GDT) to certify that it does not owe any pending import-export taxes and to also request to close its import-export tax code.

The first step after that is to destroy any financial balance invoices (value-added tax and/or export invoices) that have not yet been issued. The next step is to finalize any overdue taxes, for which the following documents need to be submitted to the tax department:

- A decision on dissolution;

- Minutes from the assets liquidation meeting;

- The latest annual financial report;

- A notice on the destruction of any unused invoices; and

- Any other relevant accounting/tax documents.

Next, the company will need to finalize its personal income tax and corporate income tax requirements up until the actual date of the proposed dissolution.

Please note that the company's tax code will be closed after it is dissolved. For this step, the tax department will issue a confirmation on tax fulfillment.

Debt resolution

The resolution on dissolution must be sent to creditors together with a notice of the settlement of the debt.

A company will be allowed to dissolve after it ensures to discharge any and all debts and property obligations in the following order:

| Unpaid wages |

| ↓ |

| Retrenchment allowances |

| ↓ |

| Social insurances |

| ↓ |

| Tax liabilities |

| ↓ |

| Other debts |

The company must also set up a meeting to liquidate its assets, and the subsequent meeting minutes should include the following information:

- The time and place of the meeting;

- The establishment of a liquidation team;

- A list of all of the company’s assets;

- The method(s) used to resolve those assets; and

- The payable amounts that the company actually owes.

Bank account closure

Each of the company’s bank accounts must be closed in compliance with the policies of the location in which the bank accounts were opened. After which, the company owner has to request that the bank issue a document to certify the closure of the accounts. If the company had never opened any bank accounts, it must write a statement detailing as much.

Business de-registration procedures

Finally, the company must submit online to the Business Registration Office (BRO) to cancel the Enterprise Registration Certificate and the company’s tax code, as well as submitting to the Department of Finance (DOF) to notify them of its dissolution and cancel the Investment Registration Certificate. The DOF is the organization that handles and issues the final certification of an enterprise’s dissolution in accordance with the law.

For the application submitted to the DOF, the dossier must include:

- The company’s original investment certificate;

- Board of Management meeting minutes regarding the dissolution of the company (except for private enterprise and one-member limited liability company);

- The decision on the dissolution of the company;

- A notice on the dissolution of the company;

- Minutes of the asset liquidation meeting (except for private enterprise and one-member limited liability company);

- A letter from the tax authority certifying that the company fulfilled all of its tax obligations; and,

- Any additional documents as requested by the DOF.

After these documents are submitted and confirmed, the company’s name will be deleted from the DOF’s list of enterprises.

Other circumstances

If an enterprise’s investment certificate/enterprise registration certificate is revoked, it must conduct the dissolution procedures within six months of the date of the certificate’s revocation. The procedures are the same as in the case of dissolution mentioned above.

Bankruptcy procedures

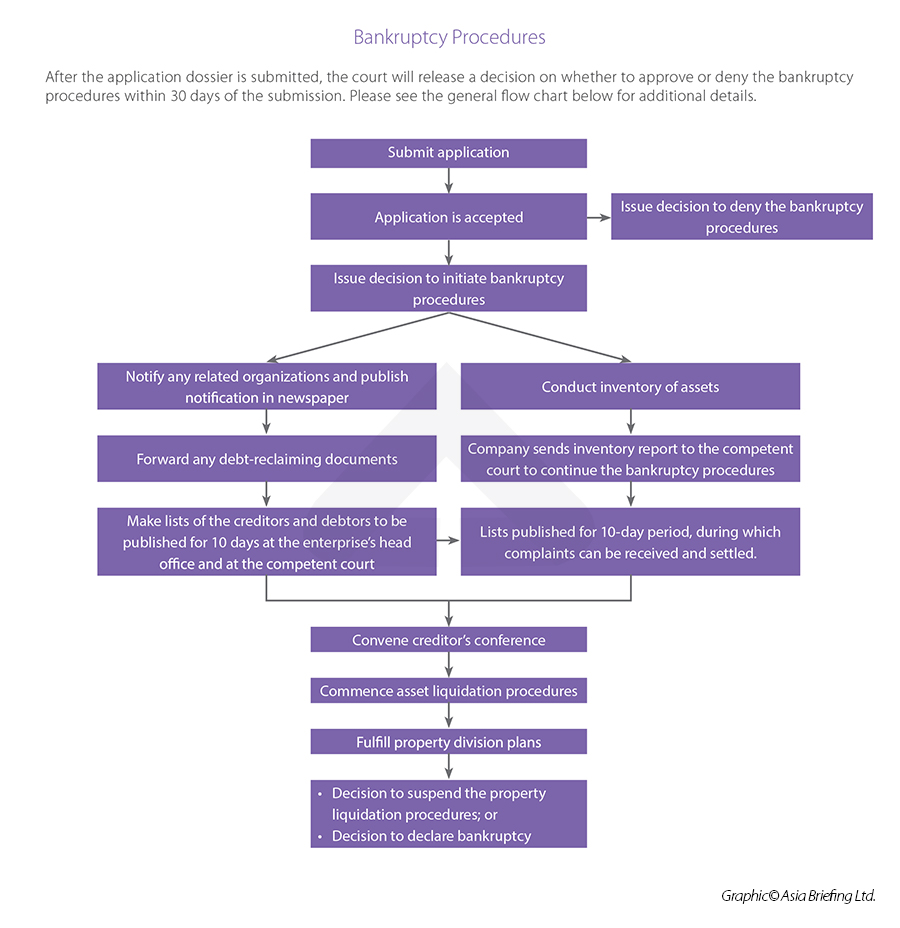

In addition to dissolution due to reasons listed above, a company can close by declaring bankruptcy. In this case, the provincial-level People’s Court is responsible for receiving and handling requests to commence the bankruptcy procedures for enterprises that are established and operated under the Law on Bankruptcy, while the People’s Court in the location of the Company’s head office will handle the bankruptcy procedures for a foreign-invested enterprise.

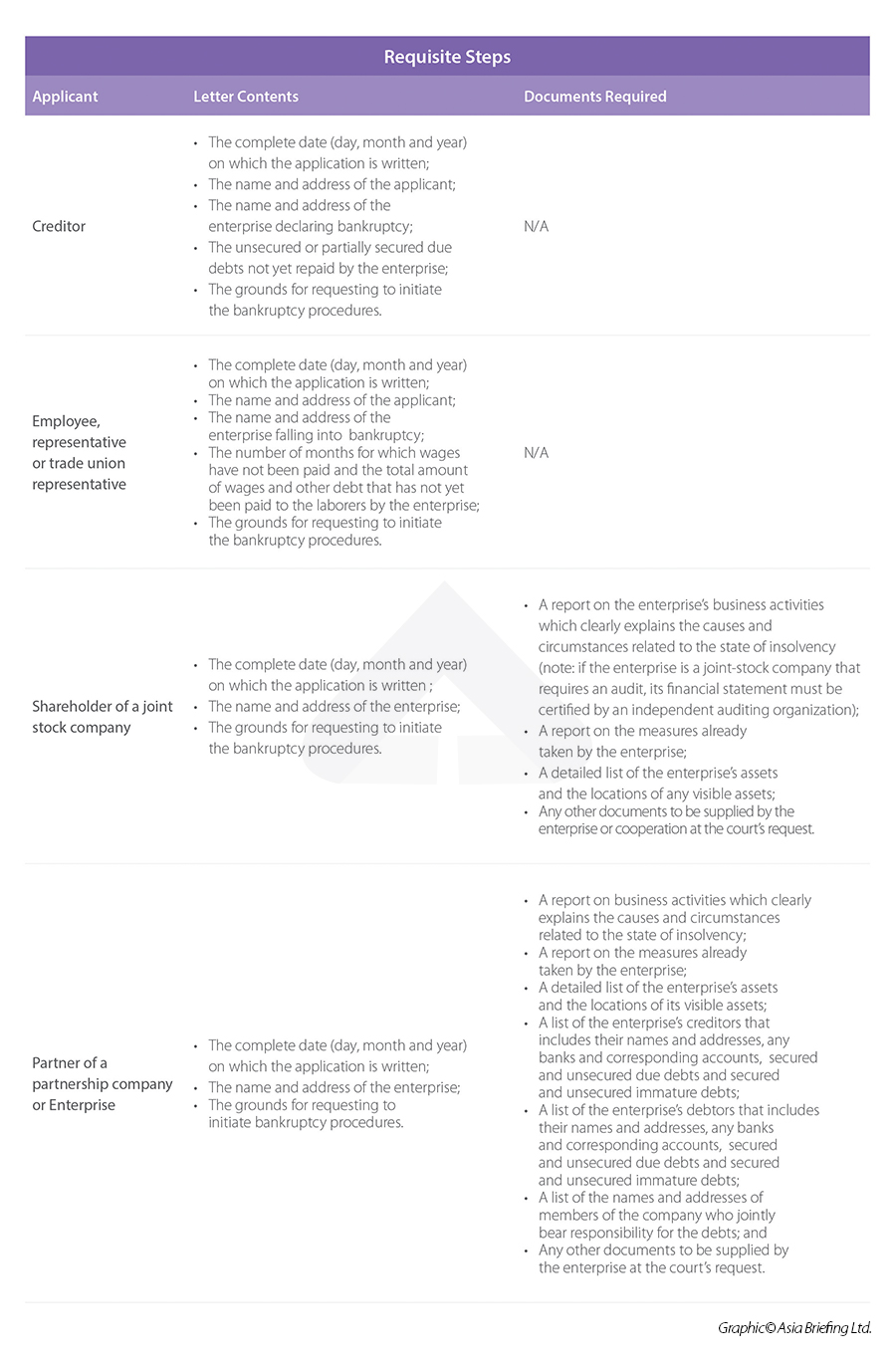

Who can apply and what needs to be submitted?

Application dossiers with accompanying letters need to be submitted to the competent court by the following people either directly in person or via certificate post to commence bankruptcy procedures as follows: