Vietnam is a large and diverse country with many of its industries which are rapidly developing and thriving. As Vietnam moves from agriculture to service to high-tech manufacturing, certain industries are becoming more prominent than others due to increased investment and government incentives.

This article looks at four of its important industrial clusters that are prime to regional supply chain shifts, and which present excellent opportunities for investors alike.

- Garment and textile cluster

- Automotive cluster

- Electronic clusters

- Food, beverage, and feed processing cluster

Garment and textile cluster

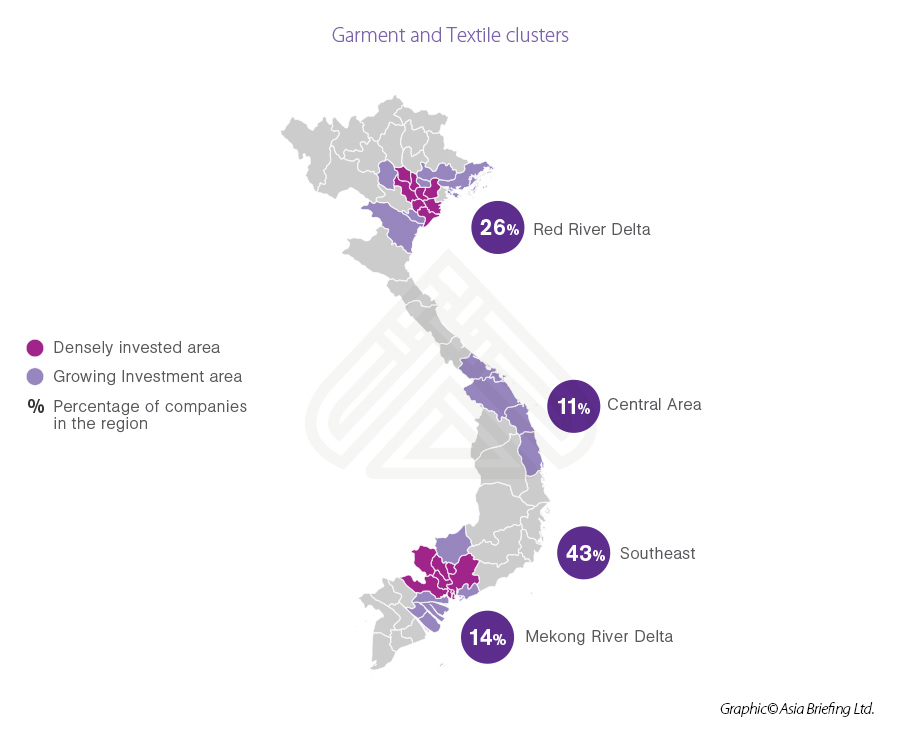

Generally speaking, the garment and textile industry is diverse. The industry comprises of, around 14,200 companies employing 1.8 million people. Large firms are surrounded and dominated by small and medium-sized enterprises (SMEs) in the south-eastern region. These companies are located in the Red River Delta. However, with improving infrastructure, companies are moving around the Red River Delta area and Southeastern region as shown below. The CPTPP and EVFTA will benefit the industry but investors must be careful about rules of origin guidelines.

Automotive cluster

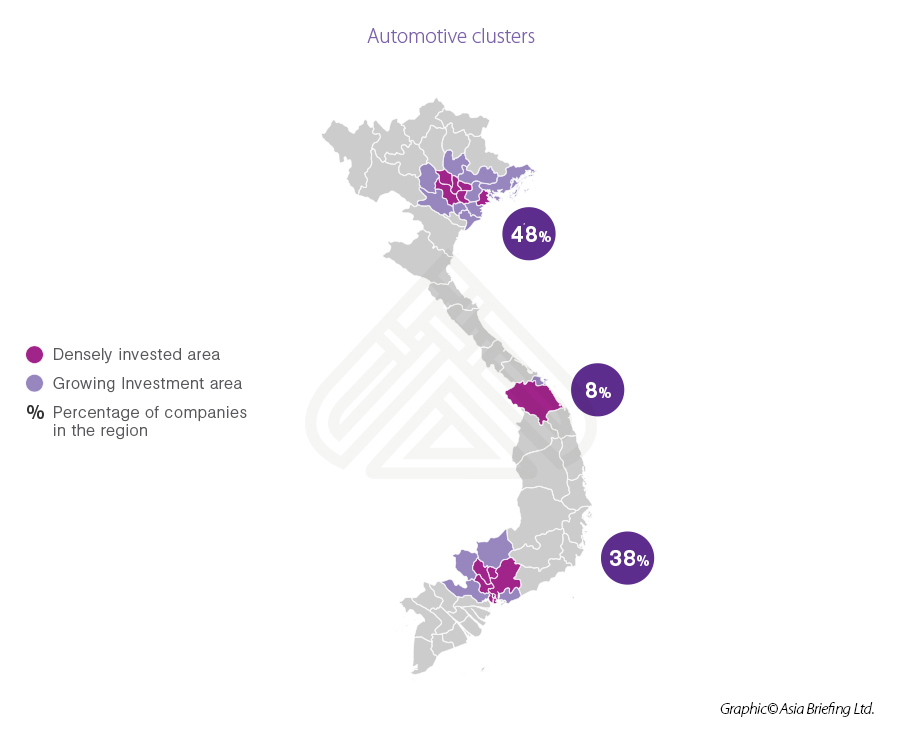

The automotive cluster has been growing at a rate of 10 percent. This is a non-resource industry for domestic local consumption.

The automotive clusters are dominated by foreign players such as Ford, Honda, and Toyota with tier-2 suppliers delivering to these global companies.

The Red River Delta region such as Hanoi and Haiphong caters to original equipment manufacturer (OEM) suppliers. In the central region, Quang Nam province has seen an increase in auto parts production. In the south, automotive clusters are concentrated in Dong Nai province and surrounding areas. Investors should watch out for strict regulations in the industry as the government is protective of the local industry and wants to help domestic players grow.

Read about the Automotive sector from and Europe-Vietnam FTA standpoint here.

Read about the Electrical Vehicle (EV) Batteries Sector here.

Electronic clusters

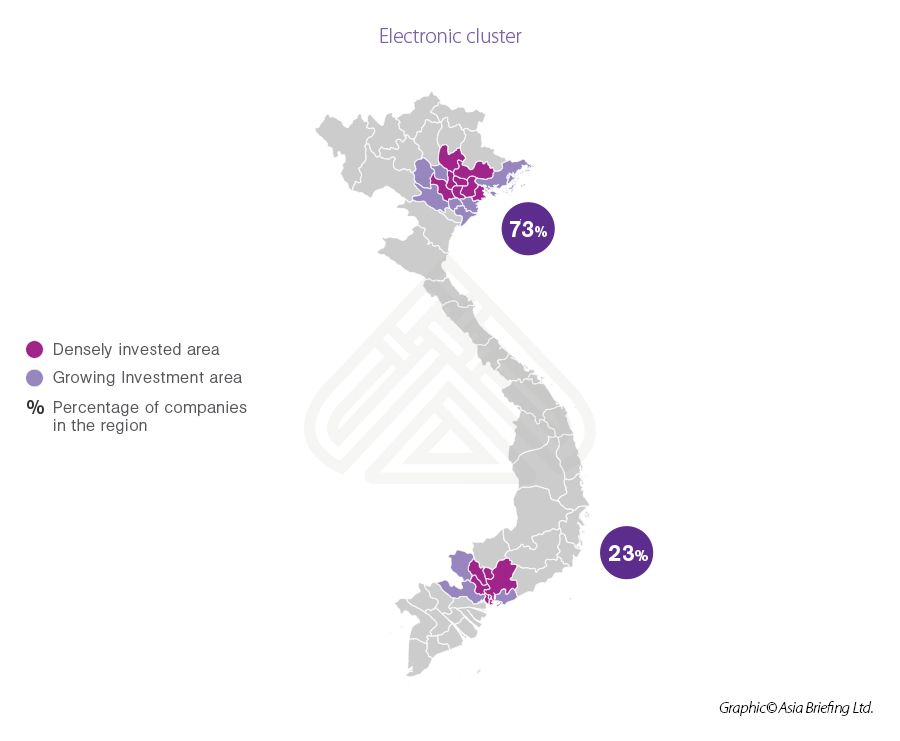

The electronic cluster is non-resource and export-oriented. The industry consists of around 2,500 companies, employing 829,000 people.

Supply chains in this cluster consist of many tier-2 companies supplying components and parts to foreign companies. Investors come from South Korea and Japan and consist of companies such as Samsung and Nokia. We have seen large investments in the Saigon Hi-Tech Park with companies also in the Red River Delta region.

Food, beverage, and feed processing cluster

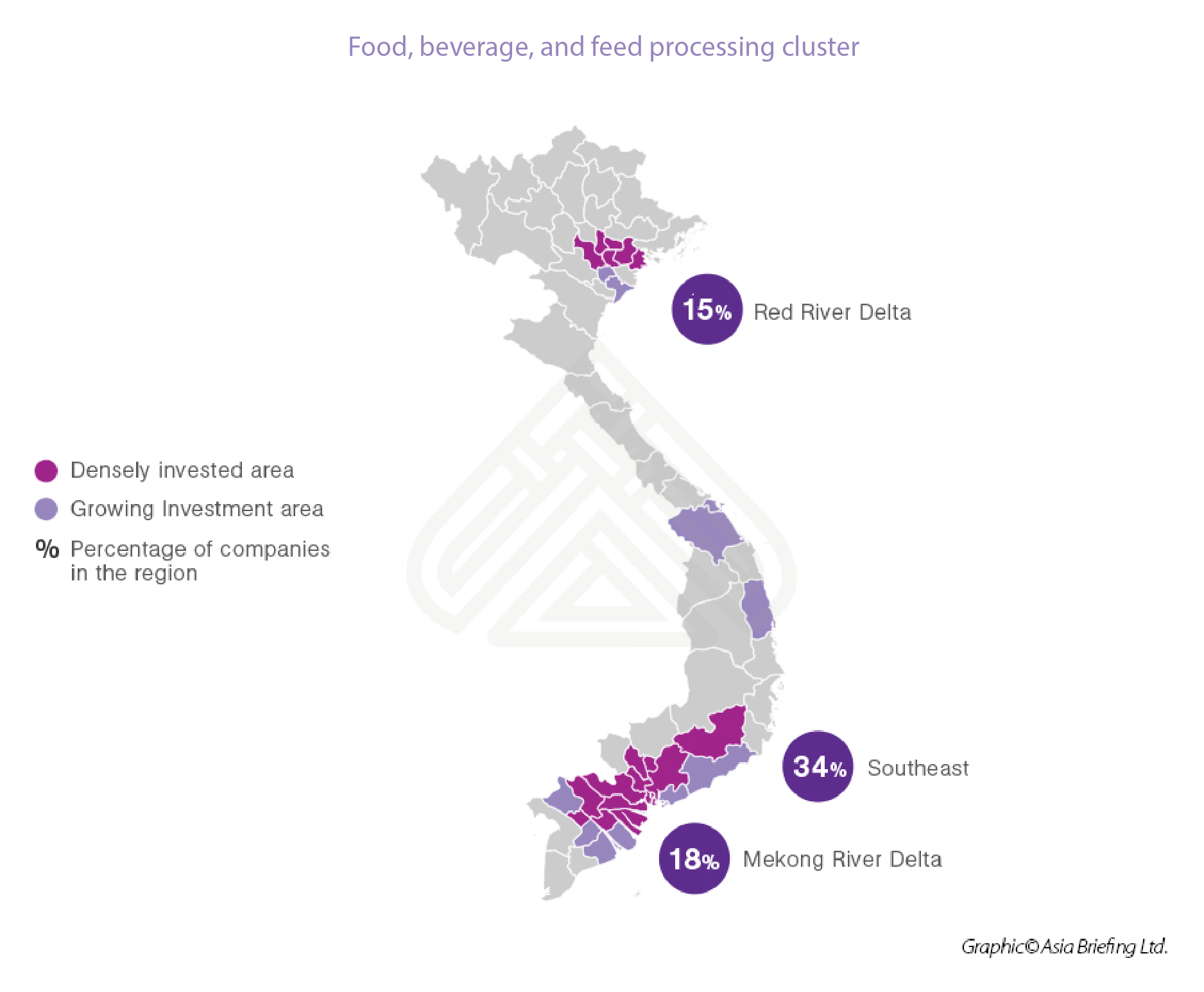

The food beverage and feed processing industry is dominated by small businesses. The industry consists of about 12,000 companies. The sector is natural resource-based with manufacturing for local and international consumption and export.

Vietnam is a leading exporter of rice, coffee, and seafood. We have also seen high demand for dairy, confectionery, and meat processing. However, companies should be located in close proximity to raw materials to source inputs and high populated areas to cater to demand.

Read about the Coffee Sector, the F&B Sector generally and the F&B Sector specific to European investors.

20 spotlight sectors in Vietnam

Vietnam is the 16th most populated country in the world, with an average economic growth that is higher than that most of other developing countries. Its top manufacturing and service industries include consumer goods, retail, entertainment, and education, although there are numerous others that are rapidly developing.

- Air Freight

- Automotive (EVFTA perspective)

- Automotive: EV Batteries

- Blue Economy

- Cold Storage

- Cosmetics

- Digital Economy

- Education

- Food and Beverage

- Food and Beverage: Coffee Industry

- Food and Beverage: Wine

- Food & Beverages (EVFTA perspective)

- Healthcare: Health Supplement

- Healthcare: Medical Devices

- Healthcare: Pharmaceuticals (EVFTA perspective)

- Luxury Goods

- Manufactiring: Industrial Supply

- Manufactiring: Machinery & Equipment

- Renewable Energy

- Retail

- Shipping

- Social Commerce