Overview of Vietnam’s Labor Code

Vietnam’s increasingly open investment environment facilitating integration with global business practices means that the country is continuously streamlining labor laws and policies.

In this regard, Vietnam approved an amended Labor Code, which came into effect in January 2021. The amendment to the labor regulations is a step towards aligning with international labor standards, particularly as Vietnam integrates into the world economy, as noted by the International Labor Organization (ILO).

Companies doing business in Vietnam must ensure they follow the provisions of the Labor Code, which contains the legal framework for the rights and obligations of employers and employees with respect to working hours, labor agreements, social insurance, overtime, strikes, and termination of employment contracts, to name a few.

Here we discuss some basic requirements that employers must follow and fulfill when hiring employees in Vietnam:

- Employee-employer contracts

- Rules for severance and payments

- Bonuses

- Allowances and benefits

- Retirement

- Protection of personal data

- Other provisions

Employment contracts

A labor contract must contain provisions such as the scope of work, working hours, rest breaks, wages, job location, terms of the contract, occupational safety and hygiene conditions, and social insurance.

There are two types of labor contracts in Vietnam:

- Indefinite term - A contract in which two parties do not determine the term and the time for its termination.

- Definite term - Two parties determine the term as a period not exceeding 36 months and the time for its termination. The definite contract can only be renewed once.

In addition, e-contracts are officially recognized and have the same validity as those in written form. A verbal labor contract is also recognized as long as it is valid for less than one month. Further, seasonal contracts are not permitted.

Full-time and part-time labor contracts have identical obligations and rights.

Companies that employ ten or more people must have a copy of company rules or internal labor regulations registered with the provincial labor department. This includes the company policy pertaining to working and rest hours, rules and orders in the company, labor safety, hygiene in the workplace, protection of assets, business and technology confidentiality, and sanction methods.

Working hours

The working hour limit is 48 hours per week; the labor code states that normal working hours cannot exceed eight hours a day or 48 hours per week. However, if the employer and employee agree on an overtime deal, the overtime cannot exceed 12 hours a day, 40 hours a month, and 200 hours a year.

- However, according to Resolution No. 17/2022/UBTVQH15, if the employer and employee agree on an overtime deal, employers are permitted to assign their employees to work overtime for over 200 hours but not exceeding 300 hours per year, except in the following cases:

- Employees aged between 15 and under 18;

- Employees having mild disabilities with work capacity reduction of at least 51% or employees with severe disabilities or extremely severe disabilities;

- Employees doing arduous, hazardous, dangerous or extremely arduous, hazardous or dangerous work;

- Female employees in their 7th month of pregnancy onward (or the 6th month of pregnancy onward in case they work in the highlands, remote areas, bordering areas, or islands);

- Female employees nursing children aged under 12 months.

For industries such as textile and clothing, footwear, and electronics, in which seasonal orders during certain times of the year require an extensive workload, an overtime cap of 300 hours has been specified.

For employees working in heavy or hazardous conditions, the law stipulates that employers are responsible for limiting their working limit due to exposure to dangerous substances or chemicals as per the national technical regulations and relevant laws.

Compensation structure in Vietnam

Minimum wages

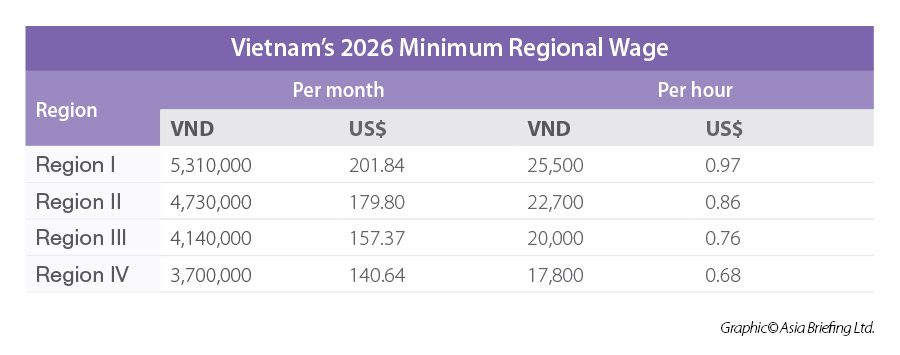

There are two kinds of minimum wages in Vietnam.

The first type is the common minimum wage of VND 2,340,000 (~US$93), which is used to calculate salaries for employees in state-owned organizations and enterprises, as well as to calculate the social contribution for all enterprises (i.e., the maximum social contribution is 20 times the common minimum wage).

The second type of minimum wage is used for employees in all non-state enterprises based on zones as defined by the government.

Performance and earnings-based bonuses for employees

Bonuses are given to employees based on company earnings and performance and as a way of boosting company morale and productivity. There are various kinds of bonuses that a company may grant its employees throughout the year.

All salaries and bonuses are subject to PIT in Vietnam.

Allowances and benefits

An employee may be entitled to several kinds of allowances and monetary or non-monetary benefits designed to retain staff. According to the Circular No. 92/2015/TT-BTC, some of these benefits are non-taxable, including:

- Payments for housing rent, power, water, and associated services for employees that amount to more than 15 percent of their total taxable income;

- Life insurance and optional insurance;

- Payment for a membership card, which does not include the user's name, of golf clubs, tennis courts, and other exclusive clubs;

- Payment for a membership card, which does not include the user's name, of health care, entertainment, etc. services;

- Telephone allowance;

- Stationery allowance;

- Uniform allowance in kind or in cash not exceeding 5 million VND;

- Lunch allowance not exceeding 730,000 VND;

- Funeral payment not exceeding any month's actual salary in the year;

- Wedding payment not exceeding any month's actual salary in the year;

- Transportation allowances;

- Training allowances;

- Employer support for fatal disease or illness;

- Round-trip flight ticket to return home country once a year for foreign employees or Vietnamese employees working abroad;

- Tuition fees for children of foreign workers working in Vietnam study in Vietnam, children of Vietnamese workers working abroad study overseas from kindergarten to high school;

- Personal incomes received from any associations and organizations if the employees receiving the grant is a member of these associations and organizations, and these associations and organization’s funding is used from the State budget or managed according to the State's regulations;

- Payments paid by the employer for the deployment, rotate foreign workers to work in Vietnam according to regulations in the labor contract, complying with the standard labor schedule according to the international practices of some industries such as oil and gas and mining.

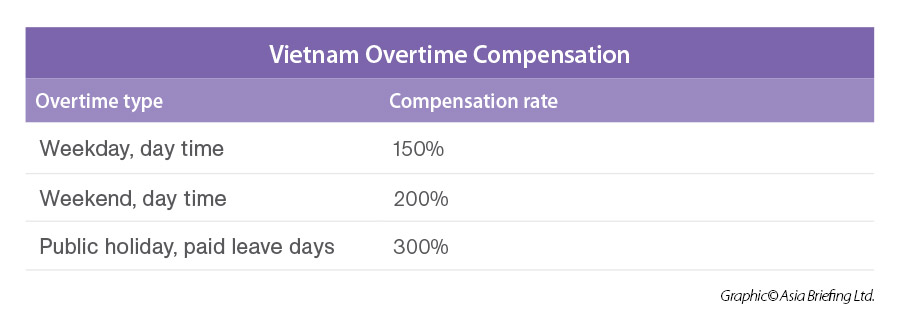

Overtime

If a worker exceeds the abovementioned limits, overtime will be triggered, and compensation will be applicable.

Employee consent must be obtained if the employer plans overtime work regarding the terms, locations, and overtime work.

In addition to working beyond a set threshold of hours, overtime compensation may be triggered and influenced by the time and date that employees are engaged. Key triggers of overtime beyond hours worked include weekends, public holidays, and night hours – defined as between 22:00 and 6:00.

Termination, severance, and payment

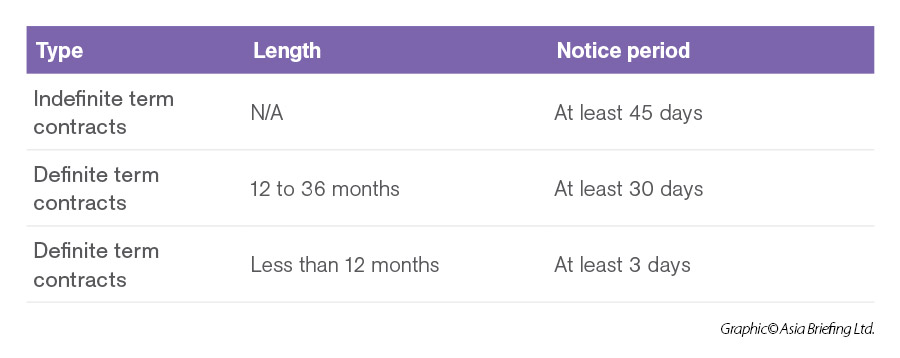

According to the legislation, employees can unilaterally terminate their employment contract without a specific reason as long as they notify their employer in advance in accordance with the labor law.

Further, employees are allowed to immediately terminate a contract for mistreatment, pregnancy, or if the employer fails to pay their salary on time.

The employer is only allowed to unilaterally terminate the employment contract in accordance with Article 36 of the Vietnamese labor law. The notice period required can vary depending on the type and length of the contract.

There are some required payments when terminating the employment contract, such as unused annual leave, severance allowance, and other payments following the signed labor contract or the company's policy.

Retirement age

Under normal working conditions, the retirement age stands at 60 years and 3 months for male employees and 55 years and 4 months for female employees since 2021. The retirement age will increase by three months per year until it reaches 62 in 2028 for men and by four months per year for women until it reaches 60 in 2035.

|

Incremental retirement age in Vietnam 2022-2026 |

|||||

|

|

2022 |

2023 |

2024 |

2025 |

2026 |

|

Male |

60 years 6 months |

60 years 9 months |

61 years |

61 years 3 months |

61 years 6 months |

|

Female |

55 years 8 months |

56 years |

56 years 4 months |

56 years 8 months |

57 years |

Further, the retirement age for employees in Vietnam is also dependent on the employees’ working conditions. Workers may retire later or sooner, depending on the situation. For example, employees working in dangerous environments or involved in heavy lifting can retire sooner, while those who work in the private sector or in highly skilled jobs can retire later. The maximum extension for this is five years.

Hiring foreign employees

Foreign companies wanting to do business in Vietnam must ensure all provisions of the Labor Code, which contains the legal framework for the rights and obligations of employers and employees, including the provisions highlighted in this article, are followed.

Further, a Vietnamese entity is permitted to recruit foreign workers to work as managers, executive directors, and experts where local hires are not yet able to meet production and business requirements. Unlike in certain other Asian countries, Vietnamese representative offices are also able to hire staff directly.

The labor code requires that the evidence of this announcement should be provided in the application for a work permit for a foreign employee. The other option is to recruit foreigners through a government-owned employment service center.

Additional provisions under Vietnam's Labor Code

Unions: Vietnam allows independent trade unions to operate as opposed to currently being supervised by the state-run Vietnam General Confederation of Labor (VGCL). The independent union is required to get permission from state authorities to operate. Allowing labor unions to operate is a requirement under several free trade agreements entered into by Vietnam.

Enterprises employing 10 or more employees are required to register a copy of their company rules—commonly referred to as internal labor regulations—with the provincial labor authority. These internal rules typically cover matters such as working and rest schedules, workplace rules and discipline, occupational safety and hygiene, protection of company assets, confidentiality of business and technical information, and applicable disciplinary measures, among other operational policies.

Salary

The government does not regulate salary policies at individual companies, however, every employer shall establish their own pay scale, payroll, and labor productivity norms as the basis for recruitment and use of labor, negotiation, and payment of salaries. The rules on minimum wages must be followed as well.

Discrimination

The labor code has safeguards protecting employees from discrimination in the workplace. This includes protection from sexual harassment and discrimination based on skin color, race, nationality, ethnic group, gender, marital status, pregnancy, political views, disability, HIV status, or if in a trade group. The labor code also enhances protections for younger workers.

Sexual harassment

The code provides guidelines to prevent sexual harassment in the workplace. This includes any form of sexual harassment, including physical, verbal, or non-verbal harassment, such as body language or display of sexual activity directly or electronically. The workplace has also been defined to include anywhere where the employee actually works, including work-related locations such as social activities, workshops, business trips, phone conversations, vehicles, and so on.

Labor supervision

Once a company begins operations, the employer must make a labor-management book at the head office, or branch, or representative office about the basic information about employees. Any changes to labor must be reported every six months to the labor department.

In addition, there are some reports related to the workforce must be submitted to the relevant Agencies.

Female employees

To make it easier for female employees, those who have children under 12 months of age are allowed a 60-minute break every day from work to breastfeed.

Female employees are also granted a 30-minute break during their menstruation period. The number of days the time off will be given can be agreed upon by both parties but must be a minimum of three working days per month.

If female employees do not have time to take the aforementioned breaks and are allowed to keep working, the employee is required to pay additional wages for the work, which is separate from overtime pay.